As slick because the Apple Card is, its options are distinctive solely of their combine, presentation, and integration into iOS. Doing enterprise elsewhere doesn’t imply you miss out on real-time fraud alerts, cost reminders, money again and the like.

In reality, the vast majority of the Apple Card’s defining options have been round for ages, and odds are they’re obtainable in a bank card you already possess. That’s significantly so if it was issued by one in all giant banks—Chase, American Express, Discover, Citibank, Capital One, or Bank of America.

Pitting these firms’ approaches in opposition to Apple’s doesn’t lead to actual equivalents, in fact. For instance, whereas most bank cards from a single huge financial institution include the advantages we’ve outlined beneath, not each one does; you’ll must confirm the particular card you’ve gotten or need has what you search. Some options additionally require handbook arrange. And a handful of options can’t be replicated in any respect.

But having a alternative past Apple means you possibly can decide the precise card for your private funds. The Apple Card versus the competitors isn’t a winner-takes-all situation, as you’ll see.

Seeking particular bank card suggestions? We’ve made a list of the best Apple Card alternatives, with callouts for finest general, finest for money again, finest for low-interest charges, and extra.

Apple Card options you may get elsewhere

Cash-back rewards

You can get money again as a reward with fairly just a few bank cards that don’t have any annual charge. These playing cards differ of their strategy. Some pay a flat price for all purchases, with the most effective ranging between 1.5 to 2 p.c. Others provide tiered rewards (just like the Apple Card), the place some classes of purchases qualify for various quantities of money again. For instance, the Discover it Cash Back doles out 5 p.c on a rotating collection of classes, and 1 p.c on every part else, whereas the Citi Costco Anywhere Visa pays 4 p.c on fuel, 3 p.c on journey and eating, 2 p.c at Costco, and 1 p.c on every part else.

The Citi Double Cash pays 2 p.c on all purchases, not like the Apple Card.

Some Apple Card followers have argued that the 3 p.c again for Apple purchases can’t be beat. That’s true however not very related to most folks, as they’ll spend higher quantities in areas like meals, journey, and residential enhancements. The Apple Card gained’t maximize rewards for them.

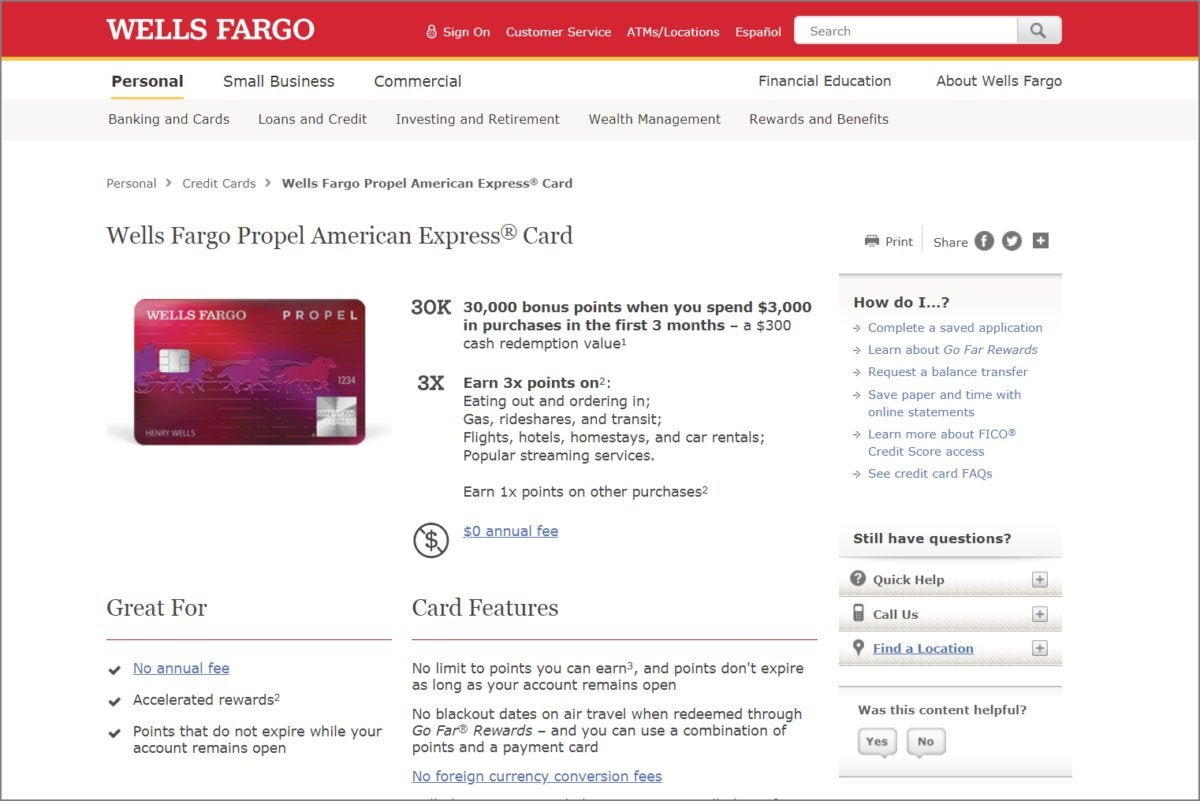

If you’re available in the market for a brand new bank card anyway, a handful of the most effective include sign-up bonuses or introductory bonus money again, which may web juicy rewards that cancel out or exceed what you’d usually earn on an Apple Card. For instance, the Wells Fargo Propel awards a $300 sign-up bonus when you spend $3,000 inside 90 days. Buying Apple items (say, a loaded MacBook) on the non-Apple Card is the smarter transfer, as you’d need to spend $10,000 on Apple services or products on an Apple Card to match that quantity.

We identify particular suggestions for cash-back playing cards in our Best Apple Card alternatives article, plus evaluate the numbers on cash-back percentages, rates of interest, and costs in our rundown of the Apple Card and its two nearest rivals.

Contactless cost

Apple

Apple Because bank cards issued by main banks are suitable with Apple Pay, you gained’t miss out on contactless cost as an possibility.

Skipping on an Apple Card really can improve your choices for contactless cost, since word on the street is that the bodily model of the Apple Card gained’t help it. The checklist of banks that support Apple Pay contains all the most important bank card issuers we researched for this text, plus an excellent variety of credit score unions and smaller banks, too. On prime of that, American Express, Capital One, Citibank, and Chase are all closely pushing bodily playing cards with tap-and-pay capabilities proper now.

End-of-the-month cost due date

Does the due date in your bank card cost fall in an ungainly a part of the month? You can transfer it. All of the massive banks allow you to decide your personal, sometimes between the first and 28th of the month, supplied your account is present. (In different phrases, you don’t have any past-due funds.*) Most banks let you choose the brand new date by way of their web site, but when not, you may also achieve this with a cellphone name.

200degrees (CC0)

200degrees (CC0)You can change your cost due date in minutes.

Why the date-range limitation, and why can’t your cost due dates fall on precisely the tip of each month, like with the Apple Card? It’s doubtless due to a strict adherence to the CARD Act of 2009. The laws say that due dates for bank card funds should be the identical day every month, and by disallowing the 29th, 30th, or 31st as choices, card issuers can comply with that legislation to the letter. (Or maybe preserve their software program programs from choking.)

The upshot of this method that you may change the date to any day inside that interval. Perhaps you don’t receives a commission on the first or the 15th, or there are different payments that fall on the finish of the month you’d want to house out. You can accommodate these.

*Some bank card issuers have additional restrictions on how quickly you possibly can change your due date and the way typically you are able to do it. You might have to attend previous the primary billing cycle for a brand new card, or previous 90 days because the final adjustment. Also, bear in mind American Express does distinguish between its credit cards and its charge cards, and Wells Fargo has some oddly specific dates which can be acceptable.

Low rates of interest

Because the Apple Card solely has the bottom rates of interest for a rewards bank card, it’s not onerous to beat it on this one level. For one, you’re not assured its very best annual share charges (APR)—that’s decided by how creditworthy Apple and Goldman Sachs discover you.

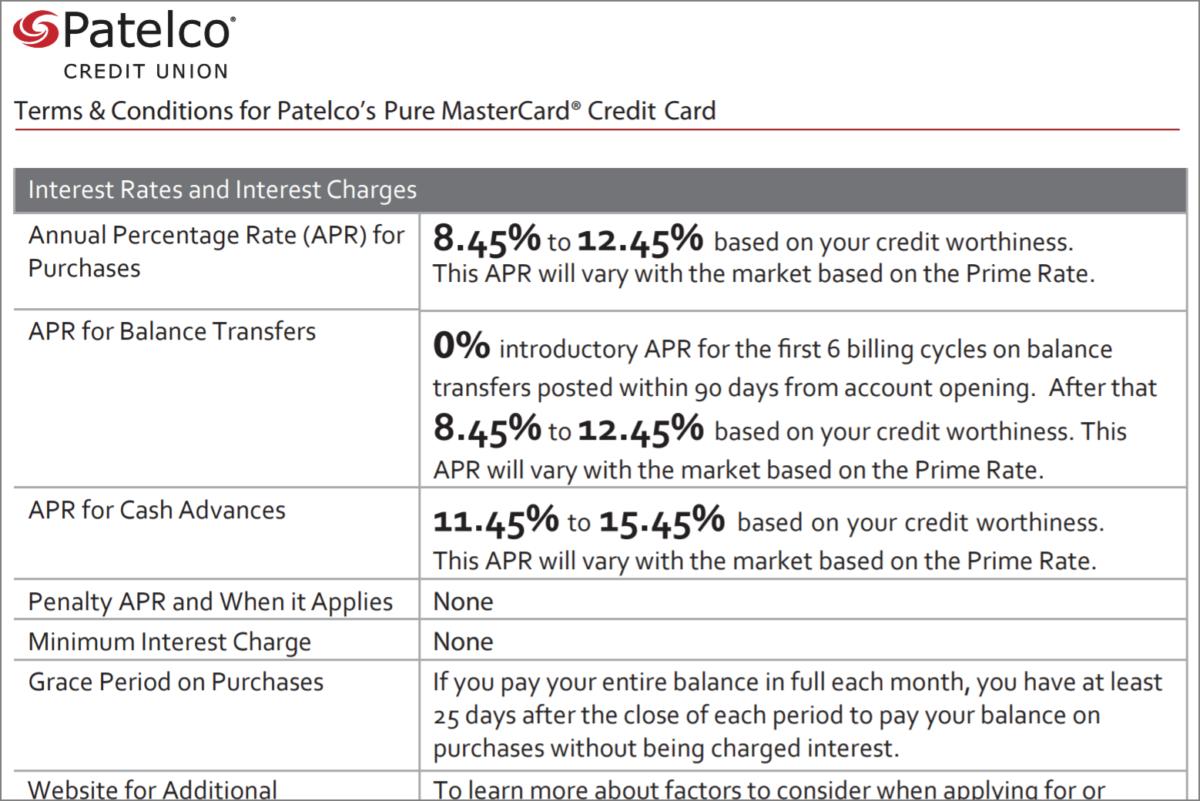

Patelco

PatelcoCredit unions are the most effective supply for simple, low-interest-rate bank cards.

Second, even if you’re saving 2 to 3 p.c over different rewards playing cards, you’re nonetheless accruing curiosity at a price that’s wherever from 6 to 27 p.c larger than the higher alternate options. Whatever you earn in rewards gained’t be sufficient to come back out forward.

You have two choices for a low-interest price bank card. The first is easy and simpler to handle: a plain, no-rewards bank card with no annual charge. Credit unions are your finest guess for one of these card, as their mission is to serve their members. They achieve this by providing decrease rates of interest on loans and bank cards, and better charges on financial savings accounts and certificates-of-deposit. Currently you could find low-interest playing cards from choose credit score unions with charges beginning as little as 7.25 p.c.

A couple of credit score unions really provide rewards playing cards with rates of interest this low, however discovering such a card is predicated on luck of geography and your affiliations. Credit unions permit folks to affix based mostly on the place they work, stay, worship, or if a relative is already a member.

The second possibility is a zero-interest bank card, which is suited solely for individuals who have glorious credit score, a selected technique round their debt, and the power to pay it off rapidly. These playing cards typically provide an introductory price of 0 p.c curiosity on new purchases and stability transfers for the primary 12 to 18 months. If you go this route, look to keep away from charges if transferring a stability, and remove your debt earlier than regular rates of interest kick in (wherever from 16 to 26 p.c).

Metal bank card

Metal playing cards much like the Apple Card aren’t quite a few, however when you drop additional down the checklist of bigger bank card issuers, you could find a slab of metallic alloy with no annual charge and a tiered set of rewards.

Wells Fargo

Wells FargoLike the Apple Card, Wells Fargo Propel American Express card is product of metallic and has cash-back rewards.

The standout instance is the Wells Fargo Propel, an American Express card that has no annual or overseas transaction charges, and as much as 3 p.c again on choose classes. It’s not a great possibility for anybody planning to hold a stability from month-to-month although, because the rates of interest are a lot larger than the Apple Card’s. (But as talked about above, you actually shouldn’t carry a stability on a rewards card anyway.)

Dedicated vacationers have extra selections, however getting into that path is a distinct technique than with an Apple Card. To take advantage of out of a card like the Chase Sapphire Reserve or American Express Platinum, you will need to repay your stability each month and dine out or journey with a sure frequency to beat the hefty annual charges.

No charges

With an Apple Card, you utterly keep away from frequent charges like these of the annual, stability switch, late cost, overseas transaction, money advance, over the credit score restrict, and returned cost varieties. That’s a rarity, however not inconceivable to seek out elsewhere. You simply must sift by means of choices from credit score unions.

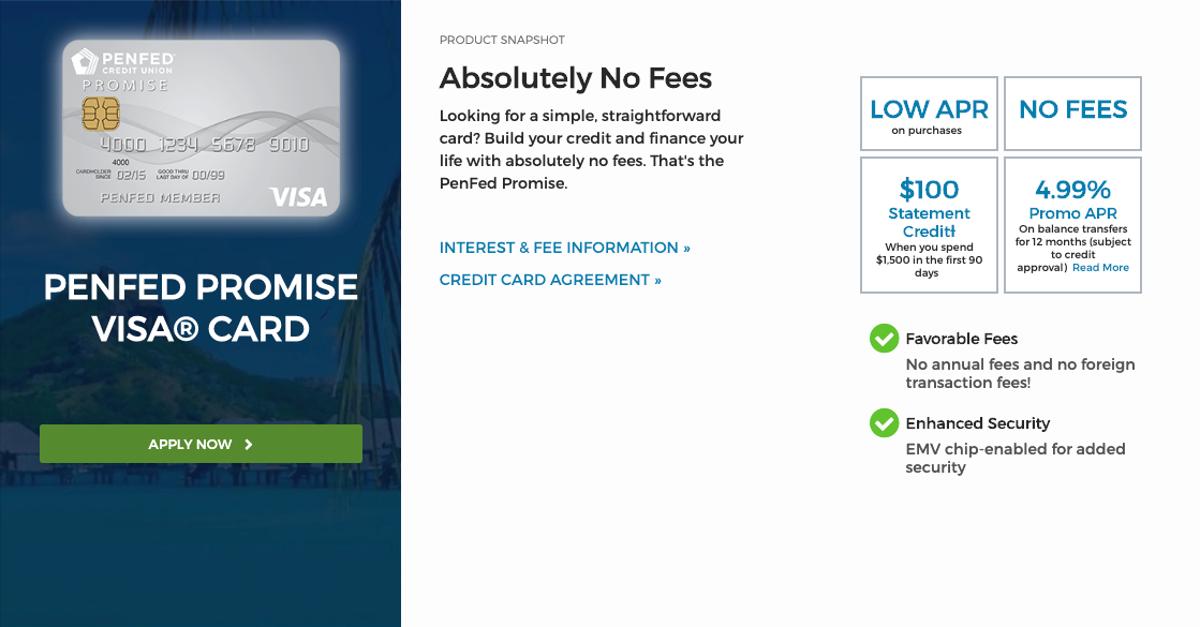

PenFed

PenFedPenFed’s Promise Visa really has zero charges.

Our searches uncovered one card obtainable to everybody (supplied that you may make a donation to charity when you’re non-military), Pentagon Federal Credit Union’s Promise Visa, and it’s doable that native credit score unions in your space might need related card. (Those close to Macworld’s workplace should not utterly fee-free, however the most effective have only a few charges together with glorious advantages. The perks undoubtedly differ from credit score union to credit score union.)

If you’re not in a position to keep away from charges all collectively, you possibly can and will keep away from just a few frequent ones. For starters, many good rewards playing cards don’t cost an annual charge. The finest ones additionally don’t cost a overseas transaction charge, which is often 1 to 3 p.c of purchases made by means of a overseas service provider.*

As for late charges, you possibly can sometimes request a waiver from customer support when you’re a buyer who sometimes pays not less than your month-to-month minimal due. Banks typically provide zero-fee stability transfers to pick clients, as properly. These choices doesn’t remotely resemble the Apple Card, in fact, however they do exist.

*Note: To keep away from by chance paying extra for worldwide purchases, all the time refuse being billed in U.S. {dollars}. The service provider’s financial institution will virtually all the time use a worse conversion price than your card’s community (Visa, Mastercard, and so forth.). This subject is separate than overseas transaction charges, so that you’re not immune even with a card missing charges.

Real-time fraud alerts

Virtually each financial institution and credit score union affords real-time fraud alerts by way of textual content message, e-mail, or by means of its app. Most bank card issuers robotically set these to fireplace if any suspicious exercise is detected, however you possibly can affirm they’re energetic by logging into your account. (Look for “account alerts.”)

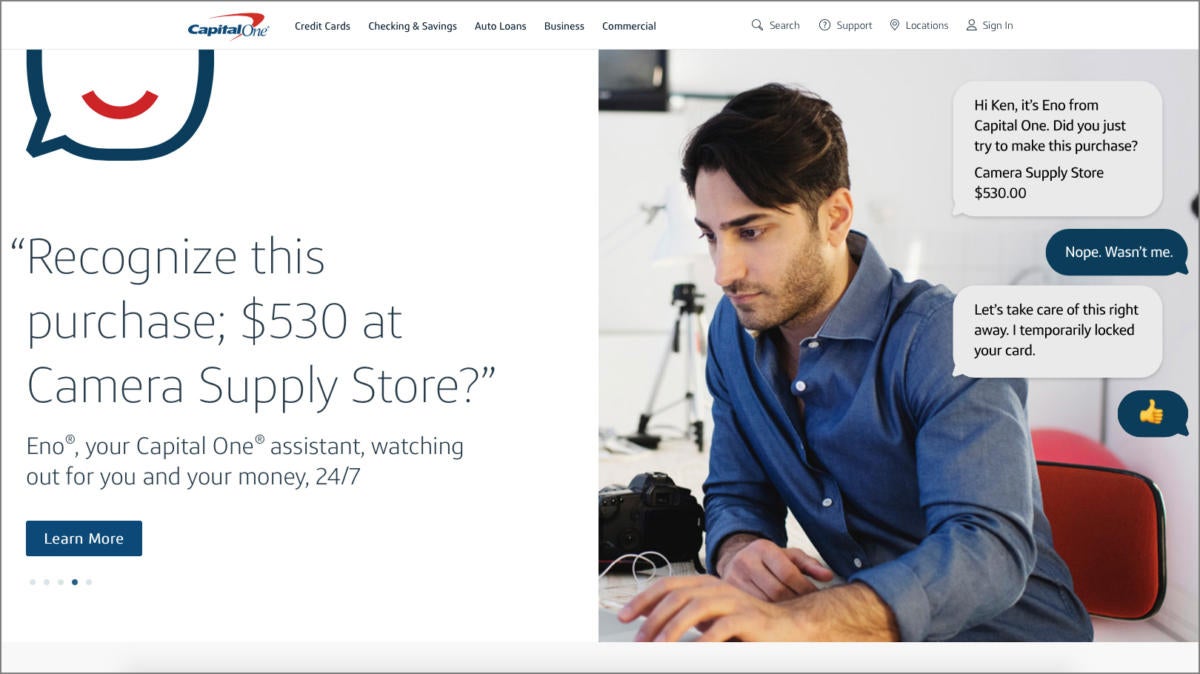

Capital One

Capital OneThe Apple Card shouldn’t be the lone bank card providing real-time fraud alerts.

When performing that double-check, you may also change your preferences for the way alert are despatched. Receiving messages by means of the app is barely safer than textual content messages, because the latter are weak to hijacking (primarily by means of somebody stealing your cellphone quantity and transferring it to a SIM card of their possession).

In addition to fraud alerts, which depend on algorithms based mostly in your spending habits and common fraud tendencies, you may also manually set alerts for costs as a backup for catching suspicious exercise. You can set these to set off if a purchase order exceeds a specific amount, and a few issuers like Bank of America and Chase additionally allow you to set it based mostly on location, reminiscent of a fuel station or on-line. The actual choices differ by establishment.

Payment reminders (and different alerts)

All of the most important bank card issuers allow you to arrange textual content message, e-mail, or app reminders for when your funds are due. The time-frame for the way quickly you may be alerted varies between financial institution, however typically it’s a customizable interval.

You also can decide in to different alerts, like stability transfers, refunds, or costs over a specific amount. As talked about above, real-time fraud alerts are often energetic by default on accounts, however you possibly can test on these out of your account whereas logged in and customise them to fit your preferences.

The actual checklist of alerts varies barely from financial institution to financial institution, with just a few nuances explicit to every one—for instance, Bank of America enables you to monitor on-line purchases made along with your card. But general, the approaches taken by the massive card issuers largely overlap.

Spending studies

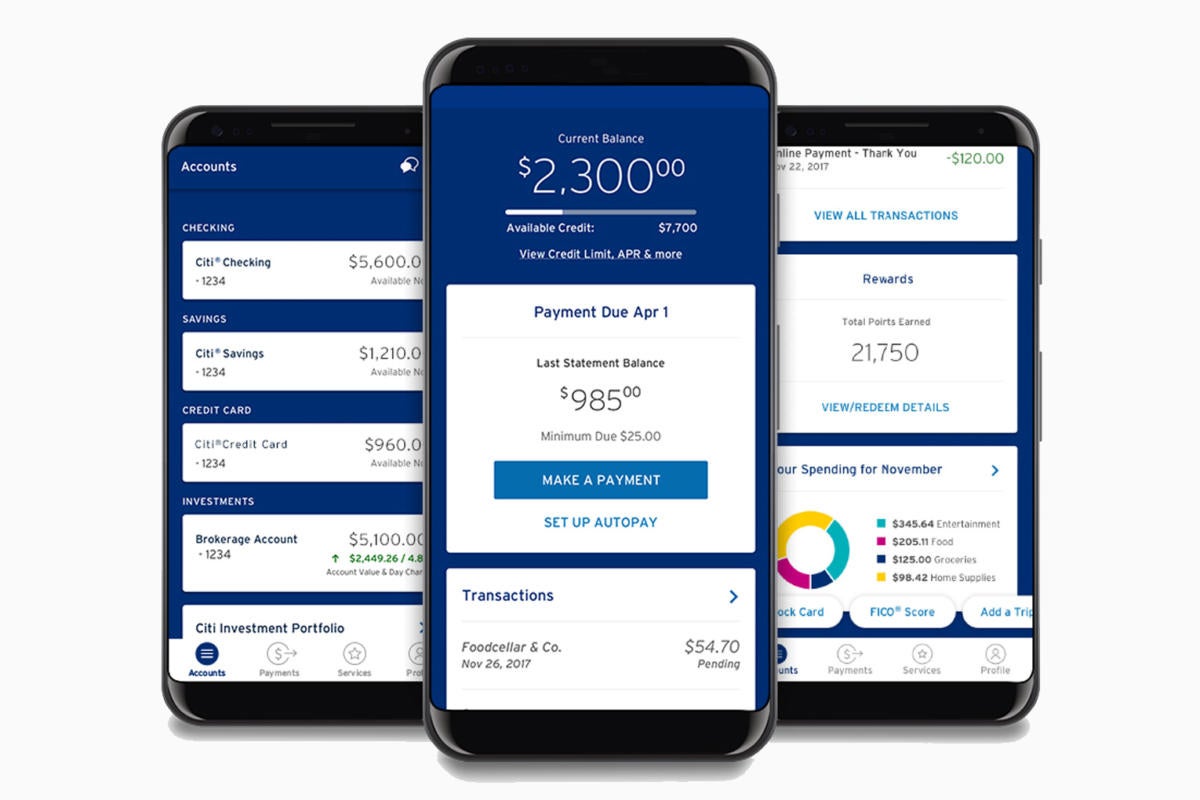

Citibank

CitibankCitibank supplies a categorized abstract of your purchases, which you’ll be able to entry by way of a desktop laptop or on cell.

Colorful bar charts do make it straightforward to see the place your cash’s going. So it’s lucky that different bank card issuers additionally break down your spending patterns. Most of the massive banks give summaries of your purchases, together with color-coded classes and the power to drill into every to see the person transactions. The characteristic goes by completely different names at every establishment—like Spend Analyzer or Trend Summary—so you’ll have to hunt a short while logged in to seek out the choice.

Of the bunch, Citibank stands out for the power to transcend weekly and month-to-month summaries. You can select customized time intervals that allow you to see even only a few days’ price of categorized purchases. Other card issuers present a minimal of yearly intervals, with firms like American Express and Discover providing a greater set of time spans that embody a month-to-month abstract because the shortest interval.

Text-based customer support

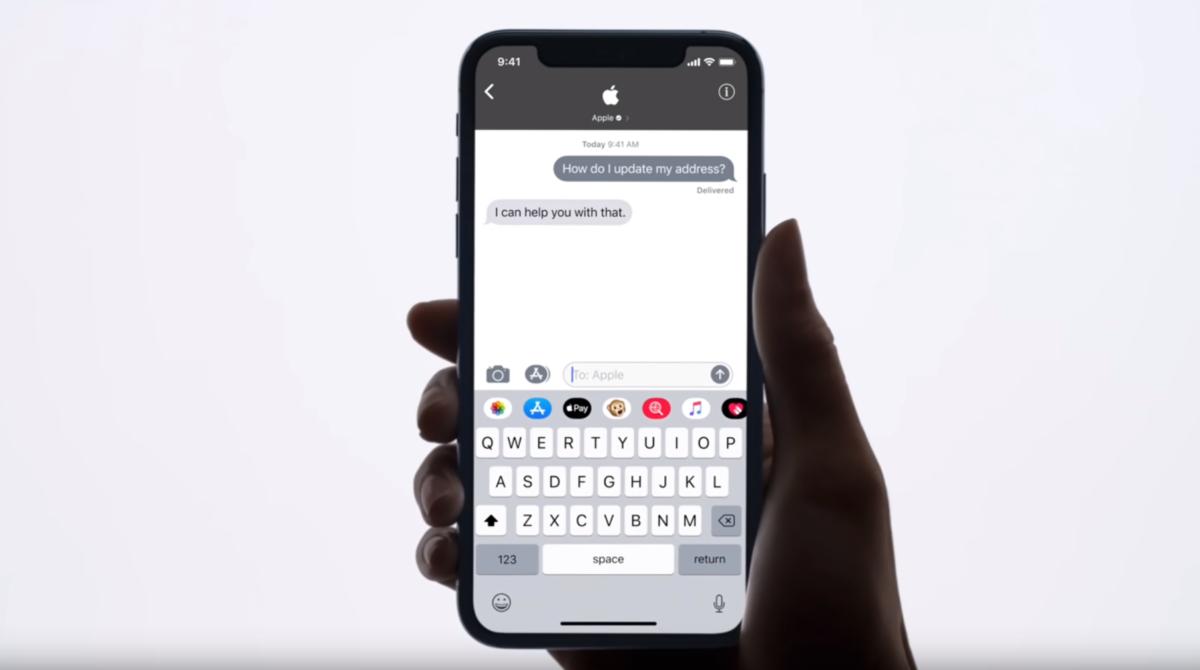

Apple

AppleDiscover and Wells Fargo additionally use Business Chat to speak with clients, although Wells Fargo’s service remains to be in a pilot section and unavailable in our space for us to strive.

Apple’s real-time, text-based customer support is a boon for individuals who hate speaking on the cellphone, a lot much less losing time listening to dreary maintain music. You get the identical stage of service and safety as you’ll by calling in, because it’s dealt with by stay brokers over Apple’s Business Chat characteristic in iMessage.

Most huge card issuers depend on commonplace SMS textual content messages for restricted, automated interplay, however two of them—Discover and Wells Fargo—additionally make use of Business Chat, opening up that very same ease of communication to their clients. (Wells Fargo remains to be in a pilot section, nonetheless, so this contact methodology is barely obtainable in supported areas.) When we tried out Discover’s service, it labored simply because the Apple Card’s does. Responses have been fairly well timed, with little backwards and forwards earlier than our query was answered.

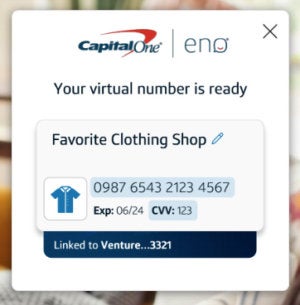

Virtual credit-card numbers

Virtual card numbers are a safety profit supplied by each Apple and its a few of its rivals, however their types of implementation differ.

For the Apple Card, a digital quantity protects you from fraud in case your bodily card goes lacking. You solely see it within the Wallet app, and solely use it for purchases made on-line and over the cellphone. It’s separate from the bodily card and the way these transactions course of.

Capital One

Capital OneCapital One and Citibank’s digital card numbers are merchant-specific, which supplies an added layer of safety if the quantity will get stolen or leaked.

This digital quantity doesn’t add any additional safety for digital and cellphone purchases. It stays fixed till you determine to regenerate it by means of the app. If it modifications, you have to to replace your billing data with each enterprise who costs you on a recurring foundation (e.g., a cellphone supplier). The course of is similar as when you needed to request a alternative bodily card from a typical financial institution, however with fewer delays.

In distinction, Apple’s rivals on this entrance —Citibank, Capital One, and Bank of America—deal with a digital quantity as a random bank card quantity with a singular expiration date and CVV tied to your account. Its particular goal is to supply privateness and safety for buying finished on-line and over the cellphone. You can create a couple of of those at a time by means of the financial institution’s web site (or if obtainable, an put in desktop utility) and use them concurrently, too.

Depending on the financial institution, these numbers will also be particular to the service provider they’re used with (Citibank, Capital One) and may have customizable expiration dates as much as one yr sooner or later (Bank of America, Citibank). Citibank additionally lets you set a customized spending restrict.

If you will need to substitute your bodily card with one which has a refreshed account quantity, you don’t must make any updates involving your digital numbers. You solely need to replace your billing data when the digital quantity expires.