The AI business is ridiculous. All you want is a cursory look to identify completely bonkers valuations, weird round funding fashions, and a dearth of viable merchandise and profitability. You don’t have to be an knowledgeable to know there’s one thing off about an business constructed round firms promising to spend trillions whereas barely making billions.

I’ve no insider info, crystal ball, horoscope, or deep AI-powered analytics of the business to again up my concept that the AI bubble will burst in 2026. But the indicators are all there and it appears awfully seemingly. Here are only a few of the various pink flags.

The cash is concentrated on the prime

Major tech firms like Nvidia, Google, OpenAI, Microsoft, Meta, Amazon, and Oracle have all seen their inventory costs explode over the previous few years as they’ve consolidated their AI efforts, pulled in gargantuan quantities of funding based mostly on AI hype, and introduced unbelievable infrastructure tasks which have upset nearly each business, from smartphone manufacturing to water administration.

Nvidia

They, in flip, are funding a couple of choose information firms. (How do you assume firms like ScaleAI grew so large, so quick?) But as for everybody else, they’re not doing so good. Indeed, if it weren’t for the massive tech firms, the US economic system would nearly actually be in a recession proper now, according to Deutsche Bank research.

That may be OK if these firms had been creating one thing genuinely progressive, worthwhile, and/or displaying actual potential to ship on their investments. But the most important motive for his or her sky-high valuations is easy: they’re all just investing in each other.

Circular investments don’t go anyplace

When Oracle introduced its $300 billion Stargate Project with OpenAI, Nvidia was set to be the key {hardware} provider. Nvidia additionally invested $100 billion of its personal in OpenAI, and Nvidia can be a significant investor in CoreWeave (one other Oracle provider). CoreWeave works intently with Microsoft, which is itself a significant OpenAI investor. Microsoft and Nvidia have additionally invested in OpenAI rival Anthropic, which has finished main infrastructure offers with Amazon and Google.

The checklist goes on. And whereas these monumental investments may need despatched firm valuations skyward, lots of them are based mostly on multi-year plans with estimates for future {hardware} supply and assumptions round prices and scalability. For all of it to succeed, it’s bought to be finished earlier than no matter AI bubble there’s bursts.

In totality, these investments are fully unprecedented, too. By 2030, McKinsey estimates that AI funding may attain nearly $7 trillion. For comparability, the complete Manhattan Project value solely $30 billion (adjusted for inflation). Yikes.

Companies aren’t making more cash

Nvidia may be making a killing on AI as the vendor of GPU-shaped shovels on this proverbial gold rush, however everybody else is struggling. Microsoft has revised AI sales targets due to poor uptake of its paid-for companies, and OpenAI has churned by means of over $150 billion in funding {dollars} simply to make $15 billion or so in income in 2025.

If OpenAI can’t determine the right way to flip a revenue with the backing of all its AI buddies, with near a billion energetic customers, and with essentially the most dominant mindshare within the AI chatbot house, who else will?

For institutionalized tech firms like Google, Meta, Amazon, and Microsoft—those with diversified companies, long-tail income choices, and expansive money stockpiles—this is probably not an issue within the brief or medium phrases. But even main firms can’t burn by means of cash endlessly. Microsoft and plenty of others have enacted huge layoffs over the past year to assist keep more healthy stability sheets, and traders are going to return calling for his or her returns ultimately.

Smaller AI firms can be affected first, however as we noticed with Meta’s disastrously unprofitable endeavors to develop the Metaverse, even huge tech firms can run dry on curiosity and momentum. What occurs then to the trillions in AI funding?

Local AI is getting significantly better

From Nvidia’s DGI Spark system to house hackers working giant language fashions on their gaming GPUs, it’s simpler than ever to run local AI on your own machine. They aren’t the highest fashions with their trillions of parameters, thoughts you, however the newest giant language fashions designed for house {hardware} have gotten more and more succesful.

Mark Hachman / IDG

OpenAI, Anthropic, Microsoft, and others would love a future the place you run all of your AI companies by means of their cloud platforms which can be gated with subscription charges, however the newest native LLMs are succesful sufficient to deal with primary textual content era, enhancing, summarizing, and picture era.

With the added advantages of improved privateness, safety, and response time for native LLMs, an increasing number of people and firms are going to pivot this fashion within the months and years to return. That’s not going to do any favors for AI firms looking for profitability.

It’s already outlasted most tech bubbles

This one may be extra of a meta level on financial bubbles than a selected level for the AI business, however huge market rallies solely are likely to final a couple of years. Yahoo Finance highlights how the dot-com bubble lasted simply over two years, the Japanese inventory bubble of the 1980s lasted three years, and the massive tech-disrupted rally after COVID slightly below a yr.

In every of those instances, their respective inventory markets noticed monumental development of a number of hundred p.c in only a few years. The AI growth hasn’t fairly managed that—it has skilled a acquire of round 130 p.c over the previous three years—however three years is already longer than most of those historic booms. If AI is a bubble that’s going to bust, then it’s nearly late going by historic traits.

AI has an influence downside

All the key AI firms have introduced their offers and are beginning to make them actuality. We aren’t going to see new rounds of trillion-dollar offers from even the key tech corporations, as even they’ve limits on the capital they’ve obtainable to them.

But scaling as much as these grandiose targets of AI information facilities everywhere in the world is proving troublesome. After buying up all the GPUs and reminiscence they’ll, a few of these firms are nonetheless struggling to carry them on-line.

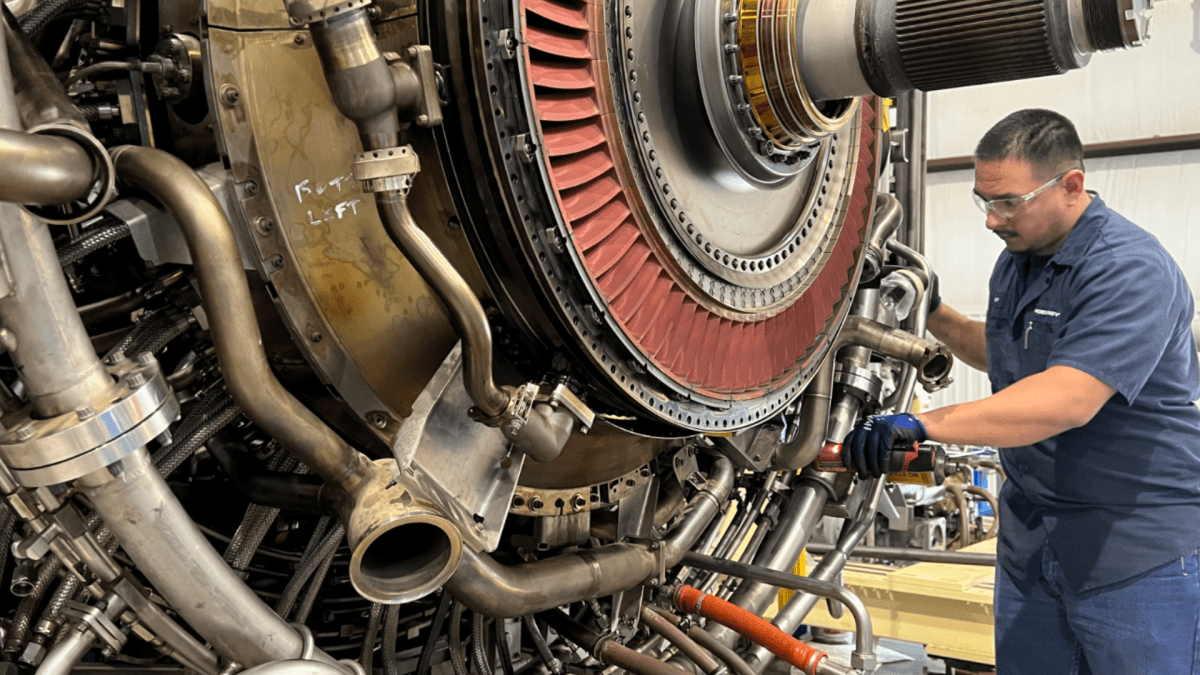

Microsoft CEO Satya Nadella said in November that the corporate now had an influence downside, which means it had GPUs that couldn’t bodily plug in as a result of it lacked the ability to run them. And then you’ve Elon Musk’s xAI making an attempt to import an influence station (no, really) and supersonic jet firm Boom Supersonic changing its jet engines into gasoline turbines (no, really!). AI wants energy, however energy is at a premium.

Power stations and their related grid infrastructures take years and even many years to construct. When energy provide fails to catch as much as their ambitions, it’s going to slam the brakes on growth. A slowdown like that’s the very last thing the AI business must maintain its hype prepare rolling.

Consumer AI fatigue may be very actual

No one likes Grok’s deepfakes and baby exploitation pictures. Fake frames in Nvidia-run video games are making players really feel like they’re probably not taking part in their video games. AI-driven memory shortages and associated price spikes for on a regular basis tech merchandise are driving folks loopy.

Dell

Companies are noticing and already pivoting, too. The most stark instance to date this yr is Dell relaunching its XPS brand at CES 2026. Sure, it’s nonetheless a “Copilot+ PC,” however you’d by no means realize it from the advertising and marketing. AI is gone from the forefront and again is the give attention to longevity, on a regular basis efficiency, and light-weight design—you understand, the issues that customers truly care about.

If nobody’s even fascinated with shopping for AI, how are these firms ever going to make it worthwhile? That’s not one thing traders are going to wish to see or hear this yr.

Global commerce points may derail every little thing

On prime of all the interior AI business elements that would result in its fall, there’s additionally international instability that would simply as prone to deal a demise blow. The US administration’s risky management retains throwing up (and tearing down) commerce boundaries. Hardware nationalization and nationalism are driving secular investments reasonably than international branch-outs.

TSMC

And because the superpowers maintain eyeing up what their neighbors have, there’s the chance of struggle stalling out the world economic system. Just China closing off Taiwan’s entry to international markets can be sufficient to break down nearly every little thing within the tech sphere.

Hopefully nothing like that involves move, however the prospect of it’s another Sword of Damocles hanging over the AI business.

Even if it bursts, Nvidia will maintain pushing

Google, Amazon, and Microsoft gained’t collapse. OpenAI most likely gained’t collapse. But the AI hype prepare of in the present day could possibly be closely derailed. The smaller and medium AI firms, and all of the corporations promising agentic revolutions for your enterprise? They’ll be gone. Stock costs will collapse, and international recession could possibly be the medium-term fallout that ultimately corrects every little thing again to some semblance of normalcy.

Long time period, although, even the businesses that stay must take care of {hardware} deprecation that’ll see them scurrying again to Nvidia each 2 to 3 years. Even with all that {hardware} energy, none of those firms are going to succeed in AGI (and even super-intelligence) with giant language fashions that may’t functionally perceive something.

AI is right here to remain, however the business as it’s can’t final for much longer. The indicators are there that 2026 could possibly be the yr all of it adjustments—once more.