Chances are high excessive you have got heard of Google. You might be doubtless a contributor to one of many three.5 billion search queries the web site processes day by day. However until you’re a enterprise capitalist, an entrepreneur or a barely obsessive know-how journalist, you could not know that Google — or, extra correctly, Alphabet, the company mum or dad to the search and web advert large — can also be within the enterprise of investing in startups. And, like most of what Google does, Alphabet invests at scale.

Immediately we’re going to undertake, if you’ll forgive the pun, a search of Google’s enterprise investments, its portfolio’s efficiency and what the corporate’s investing exercise might say about its plans going ahead.

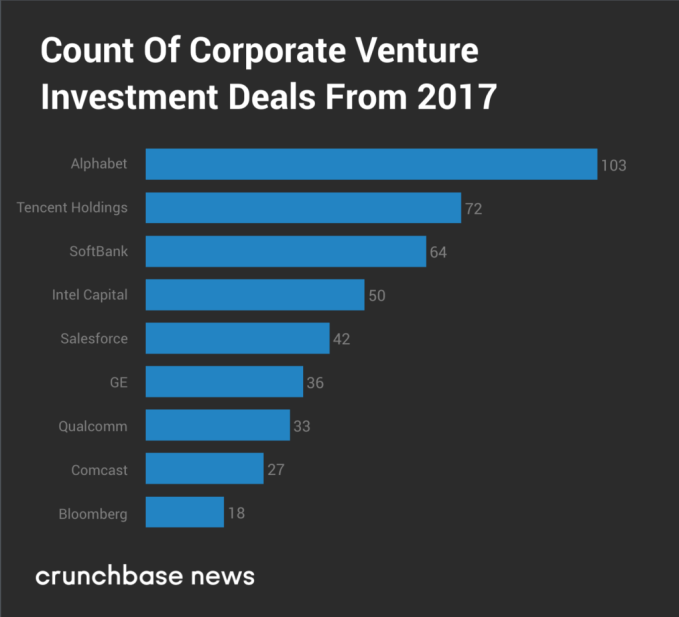

Alphabet was probably the most lively company investor in 2017

Taken collectively, Alphabet is without doubt one of the most prolific company buyers in startups. In 2017, Crunchbase knowledge exhibits that Alphabet’s three essential investing arms — GV (previously often known as Google Ventures), CapitalG and Gradient Ventures — and Google itself invested in 103 deals.

(Crunchbase Information contacted Alphabet for this story however didn’t hear again in time for publication.)

Under, you’ll discover a chart evaluating Alphabet’s funding exercise to different main company buyers, primarily based on publicly disclosed offers captured in Crunchbase knowledge.

For years, Intel and its enterprise arm Intel Capital topped the ranks of most lively company enterprise buyers. However for 2017, Crunchbase knowledge means that Alphabet’s major enterprise funds unseat the chip producer. With 72 deals struck, Tencent Holdings and its enterprise associates rank second and SoftBank, which has a $100 billion pool of capital to slosh around, is available in third with 64 deals introduced in 2017.

The Alphabet investing universe

As we alluded to earlier, Alphabet has a considerably uncommon setup for a company investor. Information exhibits that Alphabet makes the overwhelming majority of its fairness investments out of 4 major entities:

- GV, previously often known as Google Ventures, is Alphabet’s most prolific enterprise fund.

- Development fairness fund CapitalG invests primarily in late-stage offers.

- Gradient Ventures, Google’s latest fund, is concentrated on synthetic intelligence offers.

- Lastly, Google itself, has made various direct company enterprise investments.

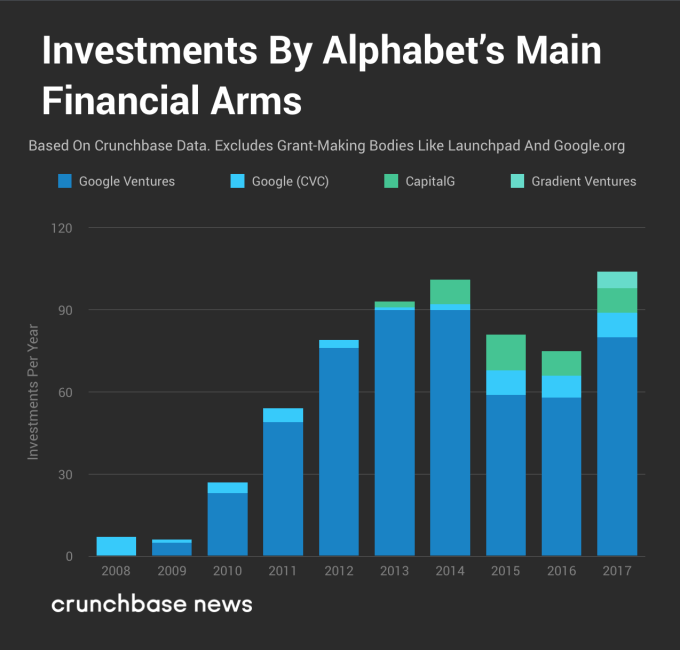

Alphabet and its funds upped their tempo of investing too, because the chart beneath exhibits:

In 2017, Alphabet’s fairness funding deal quantity topped historic highs from 2014.

Along with these fairness funding operations, Google operates the Launchpad Accelerator, which grants $50,00zero equity-free to startups in Africa, Asia, South America and Jap Europe. The corporate additionally points grants and makes impact-oriented investments out of an entity called Google.org.

Taken collectively, here’s what the Alphabet funding universe appears like:

The community visualization above exhibits the connections between Alphabet’s numerous investing teams and their respective portfolios.1 This graphic depicts 676 connections between six Google investing teams (labeled above in yellow), 570 portfolio organizations and 75 corporations that acquired Alphabet-backed portfolio corporations.

And, for probably the most half, there isn’t as a lot overlap as one might anticipate. CapitalG and GV solely share two portfolio corporations. GV invested in the seed round of Gusto, the payroll and HR software program platform, and each GV and CapitalG invested in Gusto’s Series B round. GV and CapitalG additionally invested in Pindrop’s Series C round, though CapitalG led that spherical. Other than these two corporations, although, Crunchbase knowledge doesn’t counsel some other portfolio overlap between GV and CapitalG.

Google and GV additionally share some portfolio corporations. Google led INVIDI Technologies’ Series D round, during which GV was a mere participant. Google additionally led the Series A round of standard shopper genetics firm 23andMe. Google adopted on in the Series B round, during which Google co-founder Sergey Brin was additionally an investor. GV didn’t spend money on 23andMe until its Series C. GV continued its funding all the way in which through 23andMe’s Series E. Google and GV are additionally buyers in Ripcord, an early-stage firm constructing robots that scan and digitize paper paperwork.

Shared exits

If there isn’t a lot overlap between Alphabet’s assorted funds and their investing exercise, the place is it then? The reply, it appears, could also be within the exit knowledge.

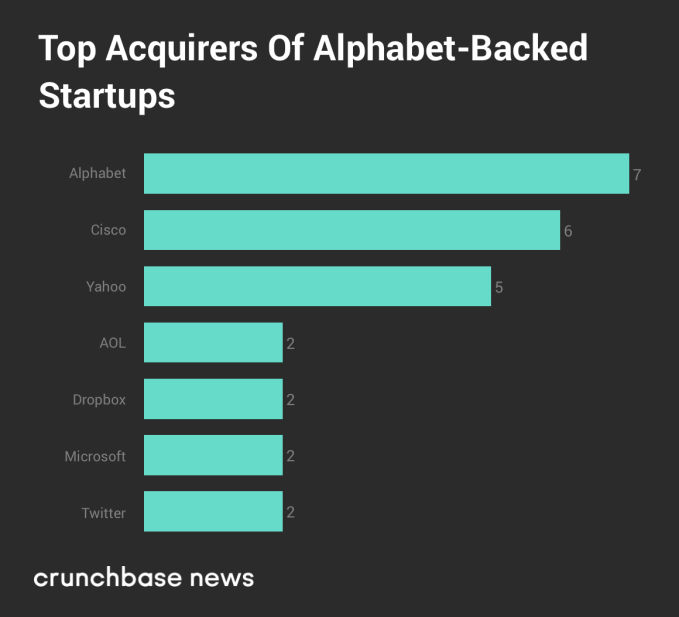

A variety of corporations have acquired startups during which a number of of Alphabet’s capital deployment arms invested. Crunchbase knowledge exhibits that 81 entities have acquired 100 companies in which Google invested. Of these, it looks as if Alphabet is its personal greatest buyer, because the chart beneath exhibits:

All in, Alphabet has acquired seven companies in which it had previously invested. Google itself acquired six corporations it beforehand invested in, and its X unit (previously often known as Google X) acquired Makani Power, an organization that developed airborne wind generators, during which Google had immediately invested. Different frequent buying and selling companions with Google are Cisco, which has acquired six Google-backed companies, and Yahoo (now, along with AOL, a part of Verizon-controlled Oath) with five acquisitions.

As an apart, Google invested in each SolarCity and Tesla, two corporations with ties to Elon Musk. In 2011, Google invested $280 million in SolarCity, an organization based by two cousins of Musk. Google and its co-founders Larry Page and Sergey Brin invested in Tesla’s Series C spherical alongside Musk, Tesla’s co-founder. Tesla went public in 2010 and accomplished its acquisition of SolarCity, a $2.6 billion all-stock deal, in 2016.

And because the community visualization above exhibits, Tesla isn’t the one Alphabet portfolio firm to go public. Alphabet funds struck enterprise offers with 11 different corporations which have since gone public, together with Baidu, HubSpot, Cloudera, Spero Therapeutics, Lending Club and Zynga.

Offers spanning A to Z

If one needed to describe Alphabet funds’ collective portfolio of enterprise offers in a single phrase, it could be “eclectic.” In contrast to many company enterprise portfolios, there doesn’t look like a unifying, cohesive theme to Alphabet’s exterior investments. The AI-focus of Gradient Ventures apart, Alphabet is simply as prone to spend money on a homeowners insurance company like Lemonade or a customer support platform like UJET (which Crunchbase News covered recently) as it’s to spend money on non-dairy milk producer Ripple Foods or African tech recruiting platform Andela.

The variety of Alphabet’s enterprise investments echoes the various assortment of companies, initiatives and long-shot bets underneath its corporate umbrella. And identical to it’s troublesome to foretell what sort of new venture Alphabet will launch subsequent, evidently no quantity of looking out and sifting can say what its enterprise arms will embrace subsequent.

- The community visualization was created utilizing Gephi, an open-source software program bundle used for making community visualizations, and the ForceAtlas2 structure algorithm.

Featured Picture: Li-Anne Dias

!function(f,b,e,v,n,t,s)(window,

document,’script’,’//connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1447508128842484’);

fbq(‘track’, ‘PageView’);

fbq(‘track’, ‘ViewContent’, );

window.fbAsyncInit = function() ;

(function(d, s, id)(document, ‘script’, ‘facebook-jssdk’));

function getCookie(name) ()[]/+^])/g, ‘$1’) + “=([^;]*)”

));

return matches ? decodeURIComponent(matches[1]) : undefined;

window.onload = function()