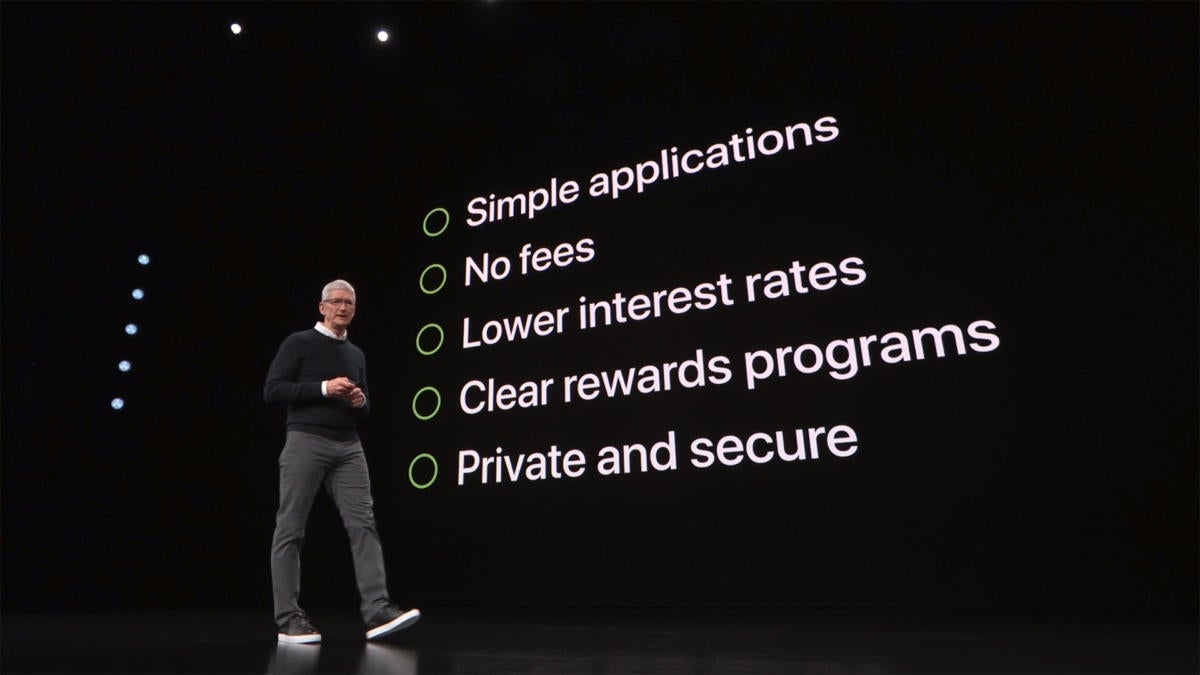

Apple won’t be turning right into a financial institution, but it surely desires to deal with your cash. But whereas we heard lots about monetary well being, rates of interest, and costs on the stage throughout Monday’s announcement of the Apple Card, the onerous numbers behind Apple’s new cash-back rewards bank card constructed on prime of Apple Pay have been notably absent. Though Apple made fast references to zero charges and cash-back percentages whereas taking digs at different playing cards, a lot of the reveal targeted on simplicity, safety, and ease of use.

Apple trumpeted the Apple Card as a counter to competing bank cards that supply point-based rewards for issues like miles and reward playing cards, but it surely’s not just like the Apple Card is totally distinctive in providing money. Several different bank cards supply related cash-back advantages too. So the place does the Apple Card differ? We dug into the nitty-gritty particulars of cash-back percentages, rates of interest, and costs and crunched the numbers to see how the Apple Card will stack up towards the preferred cash-back playing cards on the market.

Apple Card vs the highest cash-back bank cards

Among the preferred cash-back bank cards, these with probably the most related payouts to the Apple Card are the Citi Double Cash, the Chase Freedom Unlimited, and the Capital One QuickSilver. The Double Cash accrues a complete of two p.c money again on purchases, whereas the Freedom Unlimited and QuickSilver give again 1.5 p.c. (Discover additionally provides money again as an alternative of factors, however solely 1 p.c on most purchases and 5 p.c again on a collection of rotating classes.) All of the playing cards right here don’t have any annual charge, too, similar to the Apple Card.

As the chart above exhibits, not one of the non-Apple Card opponents are totally fee-free, nor are all of them that simple. So Apple positively comes out forward on that entrance, with clear phrases and minimal penalties. So far, anyway. There’s lots we do not know in regards to the Apple Card. Until we see the complete settlement with a breakdown of rates of interest and costs we cannot know precisely how Apple handles issues like money advances and steadiness transfers, however the data we do know is unlikely to alter between now and summer season.

When you dive into the numbers to see how good of a deal the Apple Card is, you may discover that the hole between it and its rivals is not as broad as you may suppose. Since the Apple Card is a rewards-based bank card, a number of key concerns makes the promise of zero charges and decrease rates of interest much less weighty.

Macworld

MacworldPurchases made with the bodily Apple Card will accrue cash-back at a 1 p.c charge.

First off, you want an iPhone. Since it is primarily based on Apple Pay, sign-up and storage is completed within the Wallet app, which is not out there on some other system, together with the iPad. So whereas there are no annual charges, chances are you’ll find yourself paying a month-to-month surcharge within the type of your telephone funds.

And then there are the precise phrases, that are largely out of Apple’s fingers and set by the issuing financial institution Goldman Sachs. If you’ll be able to’t repay your steadiness in full each month, you in all probability shouldn’t be involved about utilizing a rewards bank card. Not solely is the variable rate of interest you are more likely to get greater than when utilizing a normal bank card, the additional cash you’ll pay in curiosity obliterates the good thing about any rewards you’re incomes.

What’s extra, for those who have a tendency to hold a steadiness, the Apple Card’s lowest rate of interest won’t matter anyway. Like all playing cards, one of the best charges might be reserved for folks with sterling credit score rankings who repay their steadiness each month. And whereas Apple’s charges could begin decrease than competing playing cards, on the higher finish they cap out just like the competitors, at roughly 25 p.c.

On prime of all that, many different playing cards different sign-up bonus rewards, which Apple did not speak about Monday. The Capital One and Chase Visa Signature playing cards each supply each $150 sign-up bonuses, and there are extra perks baked in akin to prolonged guarantee safety, buy safety, misplaced baggage reimbursement, and journey cancellation insurance coverage. These advantages can even have financial worth for those who make the most of them, and Apple did not expose something past primary phrases and options throughout its presentation.

Good deal vs. nice deal

Macworld

MacworldWhen additional particulars on rates of interest (like for money advances) are launched, we’ll have a greater image of simply how good the Apple Card is towards its rivals.

Based on the phrases we do know, the Apple Card could be very engaging. When confronted with sudden, determined want for funds, it’s going to be good to know that we cannot get hit with charges on prime of charges, and the Apple Card’s clear rate of interest and charge construction looks like the least painful choice. Not having to pay an extra charge for a money advance or exceeding their credit score restrict may make a tangible distinction of their monetary conditions, and the straightforward budgeting instruments make the Apple Card a powerful entry to a crowded market.

But whereas it is an excellent deal, we would not say it is one of the best. You can get extra money again in your pocket with different playing cards, particularly for those who spend closely on sure classes, akin to eating places or journey. And for those who do your homework, you’ll find different cash-back playing cards that supply even higher charges and rewards than any of the playing cards talked about right here.

Macworld

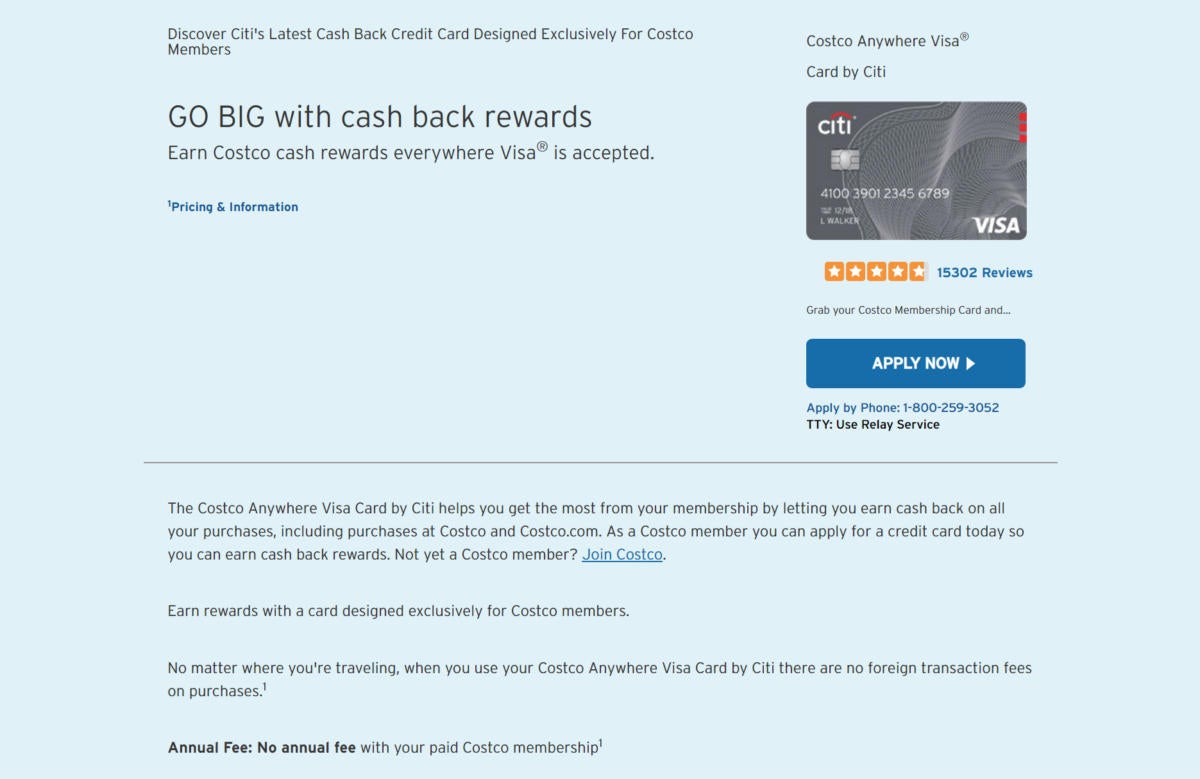

MacworldThe Citi Costco Anywhere card provides greater money again than the Apple Card in choose classes.

For instance, for those who’re a Costco member (which prices $60 or $120 a yr), the Citi Costco Anywhere card provides 4 p.c again on gasoline, 3 p.c on eating out and journey, 2 p.c on Costco purchases, and 1 p.c on every part else. And there’s additionally the Uber Visa card, which additionally provides a high-cash again charge on choose classes: 4 p.c on eating places, 3 p.c on resort and airfare, 2 p.c on-line purchases, and 1 p.c every part else. Even Apple’s own store card provides particular no-interest financing of as much as 18 months relying on what you spend (although we do not know the way for much longer that might be out there).

But with these playing cards, you may have to pay shut consideration to what you purchase and the place you purchase it. The Apple Card is about simplicity, and in that regard, it blows away its opponents. No different app or web site provides something like what Apple is promising on the subject of spending trackers, transaction lucidity, and pay down assist, and its 24/7 chat-based help may very well be a boon as effectively, particularly for those who’ve ever been bounced round an automatic system whereas attempting to succeed in an actual particular person.

So the underside line is, by the numbers, you’ll be able to in all probability perform a little higher than the Apple Card. But for a lot of iPhone customers, an additional level or p.c right here and there in all probability will not matter. The expertise and comfort might be greater than value it, and the titanium card would be the final standing image, even when savvier consumers are getting greater rewards checks.