Apple has extra cash than every other know-how firm on the planet. But, thus far, that hasn’t translated into spending on acquisitions.

Over the previous 5 years, Apple has spent the least on M&A out of all of the “Big Five” most respected U.S. know-how firms, a Crunchbase Information evaluation finds. That’s even though it’s estimated to have greater than $260 billion in money and money equivalents, together with cash parked in abroad accounts.

So is it shopping for time but? Whereas this week’s $400 million acquisition of music discovery app Shazam signifies a willingness to make big-ticket purchases, historical past exhibits Apple has made these varieties of huge offers fairly hardly ever.

The numbers

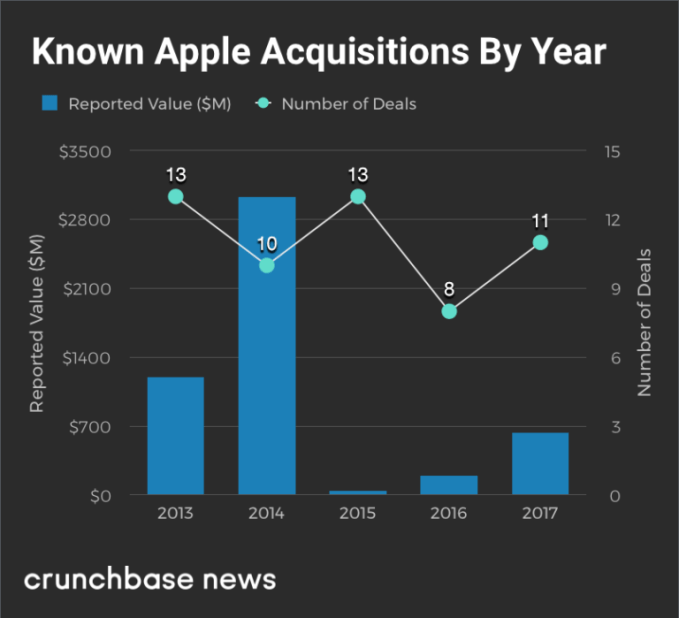

Since 2013, the iPhone maker shelled out a complete of $5.1 billion in disclosed M&A offers, in accordance with Crunchbase data. Greater than half of that went to a single transaction: the 2014, buy of music know-how firm Beats Electronics for $three billion.

deal depend alone, Apple appears to be like like a reasonably energetic purchaser. Since 2013, Apple purchased 55 personal firms, of which 11 had a reported worth. The $5.1 billion determine consists of solely these 11 firms.

The remaining 44 firms that Apple purchased for undisclosed sums are primarily early-stage startups. Whereas buy costs can’t be confirmed, such offers are usually nicely beneath $100 million and generally complete a number of million .

Within the chart beneath, we have a look at Apple’s monitor document for M&A over the previous 5 years. Deal depend has ranged from a low of eight acquisitions to a excessive of 13.

Apple’s rank within the Huge 5

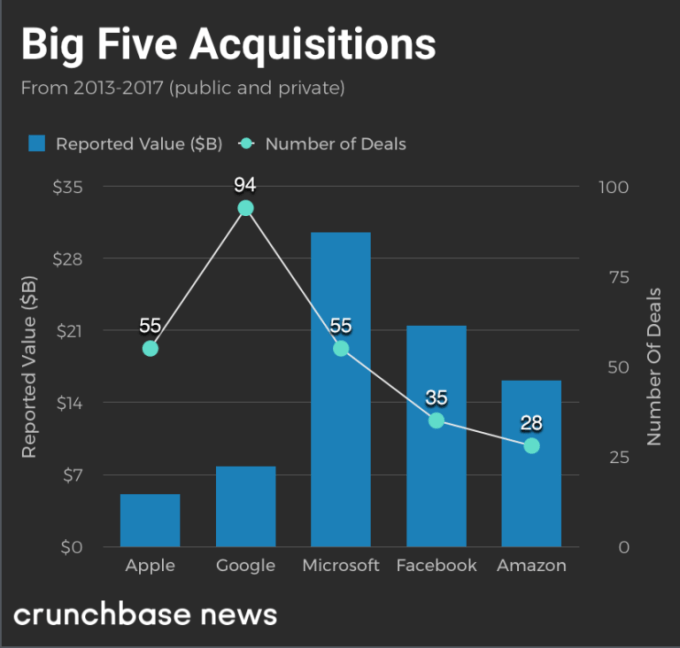

In terms of shopping for startups, Apple isn’t actually the least acquisitive of the Big Five (which additionally consists of Microsoft, Amazon, Facebook and Google).

Amazon is definitely the stingiest relating to shelling out for venture-backed firms. Whereas the e-commerce large has spent extra on M&A than Apple in recent times, that’s nearly solely due to its recent purchase of a public company, Complete Meals, for $13.7 billion.

That mentioned, Apple is a stupendously worthwhile firm, whereas Amazon is finest identified for producing huge revenues on thin-to-nonexistent revenue margins. So it’s not precisely an apples to apples comparability, pardon the pun. Furthermore, Apple hasn’t exhibited an urge for food for getting public firms in recent times.

By deal depend, in the meantime, Apple is about in the midst of the Huge 5. Its tally of acquisitions is greater than Fb or Amazon, on par with Microsoft, and much beneath Google.

Within the chart beneath, we have a look at deal counts for acquisitions by the Huge 5 over the previous 5 years, together with disclosed spending.

Spending spree forward?

There are some causes to assume Apple might be extra acquisitive in coming quarters, significantly for offers involving U.S. firms.

Tax code modifications may very well be an element. U.S. lawmakers seem near passing a tax invoice that can make it cheaper for firms to repatriate cash presently held abroad. That would probably present an even bigger home money stash for Apple to purchase American firms. Decrease company tax charges also needs to assist make that giant stockpile even greater.

Apple additionally has laid out a technique to maneuver extra manufacturing to the U.S., and that might spur offers. This week, the corporate introduced a $390 million funding in Texas-based Finisar, which makes elements utilized in iPhone X cameras. Whereas not an acquisition, the funding does reveal a willingness to spend closely on builders of applied sciences that give its merchandise a aggressive edge.

So will 2018 be the 12 months when Apple lastly goes on a shopping for binge worthy of its large money holdings? Whereas it appears compelling for a lot of causes to say sure, one can also’t assist observe that Apple didn’t accumulate that stockpile by being excessively spendy. And up to now, it hasn’t wanted numerous dear startup purchases to keep up its place because the world’s most respected public know-how firm.

Featured Picture: Li-Anne Dias

!function(f,b,e,v,n,t,s)(window,

document,’script’,’//connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1447508128842484’);

fbq(‘track’, ‘PageView’);

fbq(‘track’, ‘ViewContent’, );

window.fbAsyncInit = function() ;

(function(d, s, id)(document, ‘script’, ‘facebook-jssdk’));

function getCookie(name) ()[]/+^])/g, ‘$1’) + “=([^;]*)”

));

return matches ? decodeURIComponent(matches[1]) : undefined;

window.onload = function()