Bitcoin and blockchain are on everybody’s lips, however for many individuals they’re a closed ebook. The subject is certainly advanced. We’ll attempt to clarify a very powerful phrases as clearly as attainable.

Bitcoin (BTC) is a digital forex. The identify is a mixture of bit (smallest binary unit of data) and coin. The amount is proscribed to 21 million and 19.5 million of those have already been mined or generated.

However, as the quantity of BTC distributed decreases through the years, will probably be greater than 100 years earlier than the final Bitcoin is mined. The smallest unit of Bitcoin is a Satoshi – 0.00000001 BTC. Theoretically, it might be scaled infinitely smaller, however this is able to solely make sense if a BTC have been value rather more. For a Satoshi to be value one greenback, a Bitcoin must value 100 million {dollars} (as of the top of 2023 it was approx. 41,000 {dollars}).

There aren’t any precise figures, however consultants assume that 20 p.c of all Bitcoins mined so far are misplaced perpetually. This is because of consumer error, misplaced keys, technical glitches, hacks, and theft. The founding father of Bitcoin alone (with the pseudonym Satoshi Nakamoto) is claimed to have owned over 1.1 million BTC, that are allegedly not accessible.

Satoshi Nakamoto printed the white paper on Bitcoin on October 31, 2008. His final message was dated December 12, 2010, however it’s nonetheless unknown who’s behind the identify. There is theory that the BTC founder has handed away.

What is a blockchain?

One essential level is that the Bitcoin community doesn’t belong to anybody. It is totally decentralized (P2P) and open supply: anybody can take part. A core team takes care of the additional improvement of the software program.

If you need to perceive Bitcoin higher, you want to know what a blockchain does. Blockchain is a know-how that works like a public ledger. It information each transaction that has been made. This applies to bitcoins in addition to different cryptocurrencies.

Each web page on this ledger is a block through which a sure variety of transactions are recorded. When such a block is full, it’s appended to the chain in chronological order. The blocks are linked collectively utilizing advanced mathematical algorithms and the chain is due to this fact very safe.

In the case of Bitcoin, the blockchain is decentralized. It is due to this fact not saved in a single place, however is distributed throughout many networked computer systems (nodes or community nodes). As a consequence, no single individual or group has management over it.

Ledger is a {hardware} pockets with the size of a giant USB stick, which is good as a chilly pockets.

Ledger

Full nodes and light-weight nodes: There are a number of forms of nodes and a very powerful are the so-called full nodes. They comprise an entire copy of the blockchain and in addition validate it. The whole transaction historical past is due to this fact completely saved on these community nodes.

The duties of the total nodes are additionally subdivided once more. Some of them archive the blockchain completely, some validate it and others discard the oldest blocks to save lots of house (pruned nodes). Some full nodes additionally mine new blocks (mining nodes).

The numerous types of full nodes have very totally different {hardware} necessities. While an archive can run on a Raspberry Pi, the tiny machine will not be appropriate for mining because of its lack of computing energy.

Light nodes (also referred to as SPV nodes, Simple Payment Verification) devour hardly any sources and are sometimes utilized in wallets (purses). They talk with the blockchain for transactions and depend on the total nodes.

Mining: Blockchain mining is a metaphor for the computational work that the nodes carry out to validate the knowledge contained within the blocks. In actuality, mining is extra like checking blocks. The miners confirm the legitimacy of Bitcoin transactions and obtain a reward for doing so.

To mine a block, computer systems have to resolve advanced duties. Whoever solves the duty receives the reward for the respective block.

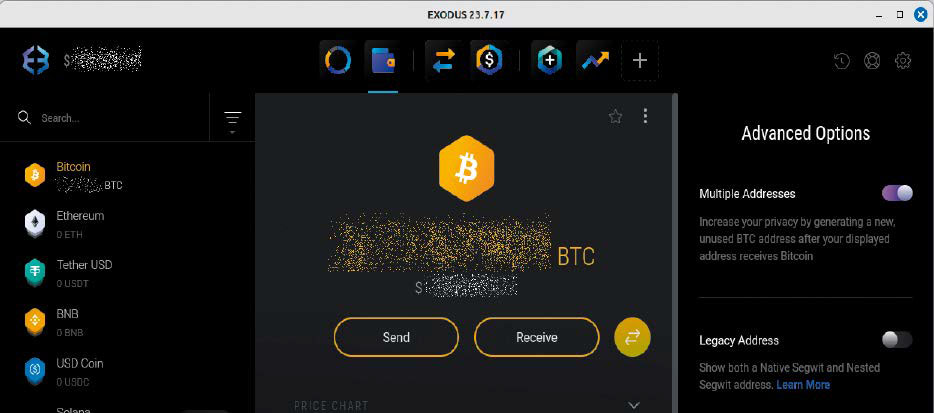

A typical crypto pockets: Exodus

IDG

An algorithm adjusts the problem of the duty so {that a} block is mined roughly each 10 minutes. The extra computer systems within the community compete for the block rewards, the upper the full computing energy, the so-called hash charge, and the upper the problem.

This kind of mining is also referred to as PoW (Proof of Work). Other blockchains, equivalent to Ethereum 2.0, use a PoS (Proof of Stake) consensus, which consumes a lot much less power however is taken into account much less safe.

Halving: The very first block (Genesis Block) was mined on January 3, 2009, and the reward at the moment was 50 BTC. An algorithm ensures {that a} so-called halving happens roughly each 4 years. This halves the quantity of BTC distributed per block. In 2012, there have been due to this fact solely 25 BTC per block. In 2016, 12.5 BTC was distributed per block and since 2020 there has solely been 6.25 BTC as a reward. The subsequent halving is anticipated in mid-April 2024, after which there’ll solely be 3.125 BTC per block. The provide will due to this fact be artificially restricted.

Wallets

You can examine a pockets to a bodily pockets. However, as an alternative of paper cash, bitcoins or different cryptocurrencies are saved in it. The most necessary knowledge in a pockets is

- The public key: This is successfully the account quantity or tackle of your pockets. You can share these addresses with different folks in order that they’ll ship you bitcoins or different cryptocurrencies.

- The non-public key: You guard this key just like the apple of your eye as a result of it’s the entry key to your bitcoins.

Many wallets provide a further restoration operate when they’re arrange, which it is best to positively use. Keep the restoration choices and your non-public key protected and ensure that no one can entry them.

Cold and sizzling wallets: When it involves wallets, there’s a distinction between sizzling wallets and chilly wallets. A sizzling pockets is a pockets that’s at all times related to the web and the blockchain. Bitcoins are often despatched by way of sizzling wallets.

A chilly pockets, then again, shops the bitcoins securely, nearly like a vault. They are also referred to as chilly storage. Cold wallets stay offline. This protects the pockets from cyberattacks and different vulnerabilities. Owners of appreciable quantities of Bitcoin will at all times divide them up in order that solely a small proportion is saved in a sizzling pockets and the remaining is effectively protected in a chilly pockets.

Creating a chilly pockets

There are a number of methods to implement a chilly pockets, with some choices being a hybrid resolution. A really safe technique is a {hardware} pockets equivalent to Ledger (approx. 80 {dollars}). However, it’s comparatively sophisticated to make use of as quickly as you need to spend bitcoins. Simply scanning a QR code is often not possible. If you need to spend bitcoins, you will need to first switch them from the chilly pockets to a sizzling pockets. However, a {hardware} pockets is ideal for long-term investments.

Alternatively, you can arrange an working system in a digital machine and arrange your pockets in it. Then write down the general public BTC tackle, disconnect the digital machine, and again it up. Now you possibly can switch bitcoins there and they are going to be saved securely.

Not fairly, however versatile: the “Electrum” pockets is already pre-installed within the Tails safety distribution.

IDG

The Linux distribution Tails has the Bitcoin pockets Electrum pre-installed. This possibility is just like the digital machine resolution. You arrange the Tails system on a USB stick and create a pockets there. You then clone the USB stick or again it up in another manner and retailer it securely.

A paper pockets was once a preferred technique. The tackle and personal key are written on a chunk of paper. There are paper pockets mills on the web, however there are additionally malicious ones. It is now strongly discouraged to create a paper pockets on-line, as these web sites may intercept the non-public key. Such wallets are due to this fact now seen very critically. If you continue to need to use a paper resolution, it’s most likely safer to create a pockets with a system equivalent to Tails after which write down the non-public keys by hand.

Popular sizzling wallets

There are many crypto wallets and most of them assist a number of cryptocurrencies. Nowadays, many wallets are user-friendly and are additionally appropriate for the much less tech-savvy. Some wallets, equivalent to Exodus, can be found for each desktop and cellular gadgets. Since it’s typically tough and cumbersome to scan QR codes with desktop wallets, smartphones are often higher suited as a sizzling pockets.

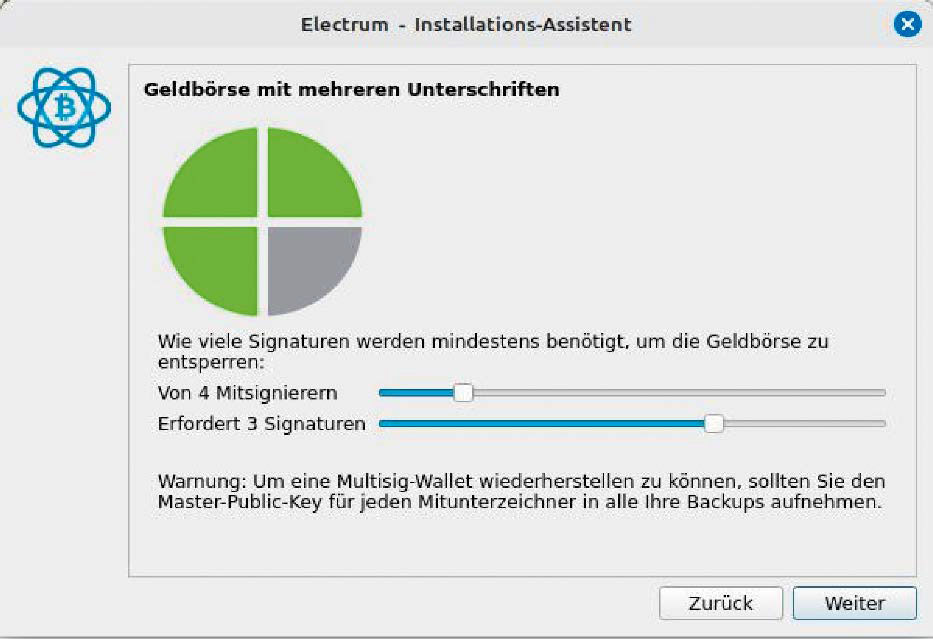

With the Electrum pockets, it’s also possible to create a very safe multisig pockets that requires a number of keys for transactions.

IDG

One of essentially the most versatile Bitcoin wallets is Electrum. Admittedly, it’s not the prettiest digital pockets, however it’s versatile and safe. One drawback of Electrum is that the software program solely helps Bitcoin. There are offshoots for different cryptocurrencies, however the authentic solely helps BTC. However, this can be a bonus.

At https://bitcoin.org you’ll discover a information that may enable you select a pockets. If doubtful and for bigger quantities, it’s best to stay to the respected suppliers.

What are multisig wallets?

Developers are more and more focussing on the utmost safe storage of bitcoins. This is why there are actually additionally multisig wallets, also referred to as multisig safes. This is a crypto pockets that requires a number of non-public keys to carry out sure duties. Of course, this considerably will increase safety, nevertheless it additionally will increase complexity. A multisig pockets requires the signature of a number of predetermined addresses to be able to perform a transaction. If a signature is lacking, no transaction is feasible.

This complexity is sensible if, for instance, a couple of individual in an organization has to authorize BTC transactions. Whether multisig is critical for people is dependent upon their private sense of safety and the quantity of BTC.

Efforts are being made to make advanced multisig extra user-friendly. One pockets with multisig assist is the aforementioned Electrum app. An various to this is able to be Sparrow, which is aimed toward superior customers however remains to be user-friendly.

Caution! Multisig is safer, however you can’t lose a single key, in any other case you’ll not have the ability to entry the funds. This signifies that a backup turns into rather more advanced: Because for those who maintain all of your keys in the identical place, multisig doesn’t actually make sense.

Wallets with Coinjoin

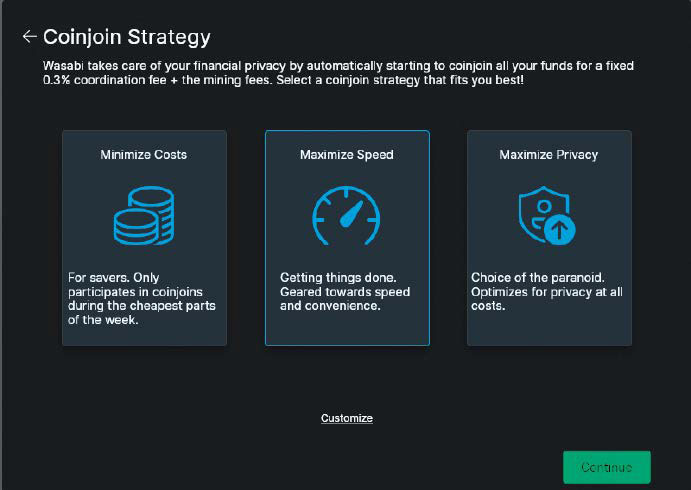

Coinjoin transactions with different folks: With Wasabi, you possibly can select which coinjoin technique you need to use.

IDG

There are additionally non-custodial wallets equivalent to Wasabi, the place coinjoin is built-in. A coinjoin is a joint transaction between a number of senders. Coinjoin signifies that you discover one other one who additionally desires to hold out a transaction. You then perform the transaction collectively at a decrease value.

Coinjoins make it rather more tough to trace transactions. This is why it’s endorsed to commonly disguise your funds on this manner. On the opposite hand, you want to watch out right here, as a result of some recipients not settle for BTC that has handed via a coinjoin for regulatory causes.

The Lightning community

One of the most important issues with Bitcoin is its scalability. Theoretically, 10 TPS (transactions per second) are attainable with BTC, however in apply even much less.

For comparability: Visa most likely manages a mean of 6,000 TPS. This is why the Lightning community was developed. With Lightning, two events open a channel and trade funds straight with one another. Once all transactions have been accomplished, the method is transferred to the Bitcoin community. In concept, there are not any limits to the TPS. In apply, solely the consumer’s {hardware} is a limiting issue.

Another benefit of Lightning is that the charges are extra favorable, which is especially necessary for small quantities. Lightning transactions additionally devour considerably much less power. Only the opening and shutting of channels is recorded within the blockchain. The intermediate transactions are solely identified to the events concerned, which in flip is advantageous for privateness.

Buying bitcoins

As mining bitcoins is often not worthwhile for a person, it’s a must to purchase them. There are crypto exchanges or exchanges for this objective. You switch cash there by way of SEPA after which purchase bitcoins. At least that’s the least expensive possibility. You have to just remember to also can switch your funds to your personal pockets.

This is feasible with Revolut, Bitstamp, and Crypto.com, however not with eToro.

There is a saying within the crypto group: “Not your keys, not your coins!” (not your non-public keys, not your cash). Anyone who has been the sufferer of a hacked crypto trade or a collapse like that of the FTX buying and selling platform can inform you a factor or two about this.

There are additionally reliable suppliers the place you should purchase bitcoins with a bank card. However, the charges listed here are often very excessive and a vital comparability is extremely really helpful. From our personal expertise, a SEPA switch to an trade registered in Europe is essentially the most favorable possibility. For most reliable crypto exchanges, “KYC” (Know Your Customer) is now necessary. This signifies that it’s a must to show your id to be able to purchase bitcoins.

Bitcoin – not nameless, however pseudonymous

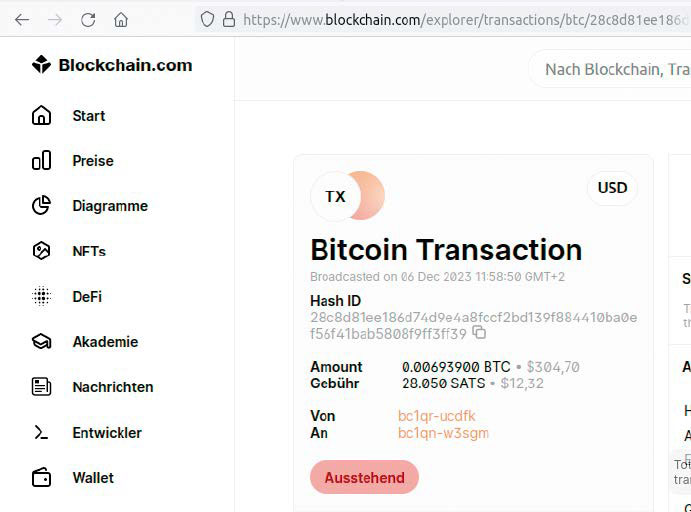

No names, however not nameless: All Bitcoin transactions are publicly seen within the blockchain.

IDG

It is commonly assumed that Bitcoin transactions are nameless. This will not be true. The right time period must be Bitcoin is pseudonymous. The transactions themselves are publicly seen and may be tracked using a special explorer.

Although you can’t see who has transferred cash to whom, the quantity and the general public addresses may be seen. Sooner or later, with endurance and adequate knowledge, it is possible for you to to see which individuals have exchanged fee strategies.

For instance, for those who purchase bitcoins from a crypto trade after which switch them to your personal pockets and use them to make purchases, it’s theoretically attainable to hint who you might be. The aforementioned coinjoin offers a treatment, however has different disadvantages.

Where can I store with bitcoins?

At https://btcmap.org/ there’s a map with outlets that settle for bitcoins as a method of fee. However, these entries are made by volunteers. It is due to this fact fairly attainable that the map is incomplete or incorrect.

There are additionally web sites equivalent to www.bitrefill.com the place you should purchase vouchers for cryptocurrencies. Well-known names equivalent to Amazon, Saturn, or Zalando are represented right here, as are well-known phone suppliers.

It’s a bit extra sophisticated, however you will get surprisingly far with voucher web sites and bitcoins. If you store there with Bitcoin, you even get cashback in BTC. Proponents of cryptocurrency argue that with BTC you possibly can present tens of millions of individuals with an account who’ve a smartphone however no entry to a financial institution.

Criticized for power consumption

Bitcoin’s excessive power consumption is commonly criticized. Bitcoin supporters emphasize that cryptocurrencies promote innovation in renewable energies and can make redundant tens of millions of ATMs, which themselves devour appreciable quantities of electrical energy.

Electricity producers additionally mine with surplus power that isn’t at the moment wanted and would in any other case merely be diverted. According to various research, BTC mining already makes use of over 50 p.c renewable power — and the development is rising.

But sure: Other research declare the precise reverse and that might certainly be dangerous to the atmosphere.

This article was translated from German to English and initially appeared on pcwelt.de.