Many entrepreneurs assume that an invention carries intrinsic worth, however that assumption is a fallacy.

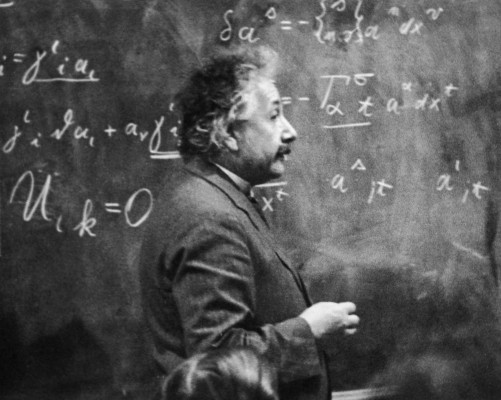

Right here, the examples of the 19th and 20th century inventors Thomas Edison and Nikola Tesla are instructive. Whilst aspiring entrepreneurs and inventors lionize Edison for his myriad innovations and enterprise acumen, they conveniently fail to acknowledge Tesla, regardless of having far better contributions to how we generate, transfer and harness energy. Edison is the exception, with the legendary penniless Tesla because the norm.

Universities are the epicenter of pure innovation analysis. However the actuality is that educational analysis is supported by tax . The zero-sum sport of attracting authorities funding is mastered by promoting two ideas: Technical benefit, and broader affect towards benefiting society as an entire. These ideas are normally at odds with constructing an organization, which succeeds solely by producing and sustaining aggressive benefit by means of limitations to entry.

In uncommon instances, the transition from mental benefit to barrier to entry is profitable. Most often, the know-how, although cool, doesn’t give a fledgling firm the aggressive benefit it must exist amongst incumbents and inevitable copycats. Teachers, having emphasised technical benefit and broader affect to draw help for his or her analysis, typically fail to unravel for aggressive benefit, thereby creating nice know-how searching for a enterprise utility.

In fact there are exceptions: Time and time once more, whether or not it’s pushed by hype or perceived existential risk, large incumbents will probably be fast to purchase corporations purely for know-how. Cruise/GM (autonomous automobiles), DeepMind/Google (AI) and Nervana/Intel (AI chips). However as we transfer from Zero-1 to 1-N in a given area, success is decided by successful expertise over successful know-how. Expertise turns into much less fascinating; the onus is on the startup to construct an actual enterprise.

If a startup chooses to take enterprise capital, it not solely must construct an actual enterprise, however one which will probably be valued within the billions. The query turns into how a startup can create a sturdy, enticing enterprise, with a transient, short-lived technological benefit.

Most buyers perceive this stark actuality. Sadly, whereas dabbling in applied sciences which appeared like magic to them throughout the cleantech growth, many buyers had been lured again into the innovation fallacy, believing that pure technological development would equal worth creation. A lot of them re-learned this lesson the arduous method. As frontier applied sciences are attracting broader consideration, I believe many are falling back into the innovation trap.

So what ought to aspiring frontier inventors clear up for as they search to speculate capital to translate pure discovery to constructing billion-dollar corporations? How can the know-how be forged into an unfair benefit that may yield large margins and development that underpin billion-dollar companies?

Expertise productiveness: On this age of automation, human expertise is scarce, and there’s unimaginable worth attributed to retaining and maximizing human creativity. Main corporations search to achieve a bonus by attracting the perfect expertise. In case your know-how can assist you make extra scarce expertise extra productive, or assist your clients turn out to be extra productive, then you’re creating an unfair benefit internally, whereas establishing your self because the de facto product in your clients.

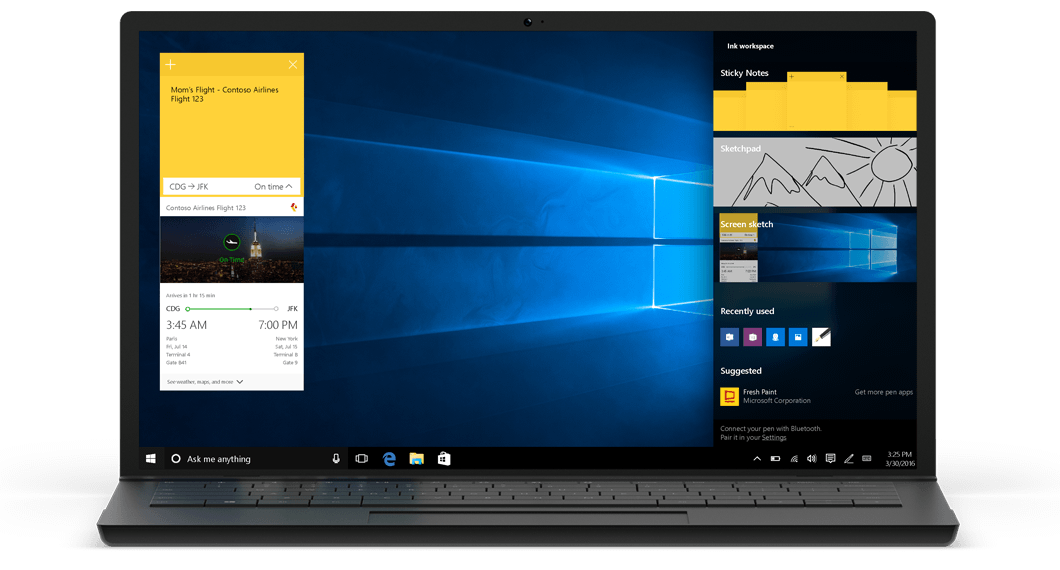

Nice corporations similar to Tesla and Google have constructed instruments for their very own scarce expertise, and construct merchandise their clients, in their very own methods, can’t do with out. Microsoft mastered this with its Workplace merchandise within the 1990s by means of innovation and acquisition, Autodesk with its creativity instruments, and Amazon with its AWS Suite. Supercharging expertise yields one of the beneficial sources of aggressive benefit: switchover price. When groups are empowered with instruments they love, they may detest the notion of migrating to shiny new objects, and persist with what helps them obtain their most potential.

Advertising and marketing and distribution effectivity: Firms are well worth the markets they serve. They’re valued for his or her viewers and attain. Even when their merchandise in of themselves don’t unlock the whole worth of the market they serve, they are going to be valued for his or her potential to, sooner or later sooner or later, be capable of promote to the purchasers which were tee’d up with their manufacturers. AOL leveraged low cost CD-ROMs and the postal system to get households on-line, and on e mail.

Dollar Shave Club leveraged social media and an in any other case deserted demographic to lock down a gross sales channel that was finally valued at a billion . The innovations in these examples had been in how effectively these corporations constructed and accessed markets, which finally made them extremely beneficial.

Community results: Its energy has finally led to its abuse in startup fundraising pitches. LinkedIn, Fb, Twitter and Instagram generate their community results by means of web and Cellular. Most market corporations must endure the arduous, costly means of attracting distributors and clients. Uber recognized macro traits (e.g. city dwelling) and leveraged know-how (GPS in low cost smartphones) to yield large development in increase provide (drivers) and demand (riders).

Our portfolio firm Zoox will profit from each automotive benefiting from edge instances each automobile encounters: akin to the driving inhabitants instantly studying from particular conditions any particular person driver encounters. Startups ought to take into consideration how their innovations can allow community results the place none existed, in order that they’re able to obtain large scale and limitations by the point opponents inevitably get entry to the identical know-how.

Providing an end-to-end answer: There isn’t intrinsic worth in a chunk of know-how; it’s providing an entire answer that delivers on an unmet want deep-pocketed clients are begging for. Does your invention, when coupled to a couple different merchandise, yield an answer that’s price way over the sum of its components? For instance, are you promoting a chip, together with design environments, pattern neural community frameworks and knowledge units, that may empower your clients to ship magical merchandise? Or, in distinction, does it make extra sense to supply normal chips, licensing software program or tag knowledge?

If the reply is to supply parts of the answer, then put together to enter a commodity, margin-eroding, race-to-the-bottom enterprise. The previous, “vertical” strategy is attribute of extra nascent applied sciences, similar to working robots-taxis, quantum computing and launching small payloads into house. Because the know-how matures and turns into extra modular, distributors can promote normal parts into normal provide chains, however face the strain of commoditization.

A easy instance is private computer systems, the place Intel and Microsoft attracted outsized margins whereas different distributors of disk drives, motherboards, printers and reminiscence confronted crushing downward pricing strain. As know-how matures, the sooner vertical gamers should differentiate with their manufacturers, attain to clients and differentiated product, whereas leveraging what’s probably going to be an countless variety of distributors offering know-how into their provide chains.

A magical new know-how doesn’t go far past the resumes of the founding staff.

What will get me excited is how the staff will leverage the innovation, and appeal to extra superb folks to determine a dominant place in a market that doesn’t but exist. Is that this staff and know-how the kernel of a virtuous cycle that may punch above its weight to draw extra money, extra expertise and be recognized for more than it’s product?