The American South will not be the primary area that involves thoughts once you hear the phrase “hotbed of tech entrepreneurship,” however, barely misguided perceptions apart, it’s house to a various and rising assortment of startups.

Right here, we’re going to take a deep dive into the startup funding knowledge for the area.

What’s “the South?”

Similar to it’s a typical pastime for a lot of metropolis dwellers to argue in regards to the exact boundaries of neighborhoods, there’s typically some disagreement in regards to the actual contours of the U.S.’s varied areas. To quash rabble-rousing from the get-go, we’re utilizing the U.S. Census Bureau’s definition of “the South” on its official map of america. Beneath, we show a map of the states we’re going to have a look at at present.

Very like barbecue, the South shouldn’t be a monolithic idea. So to include some regional taste into the next evaluation, we’re additionally going to make use of the identical regional divisions that the U.S. Census Bureau makes use of.

By doing this, we’ll be capable of get a greater thought of the relative contribution states from every sub-region make to startup exercise within the South total.

The ebb and stream of deal and greenback quantity

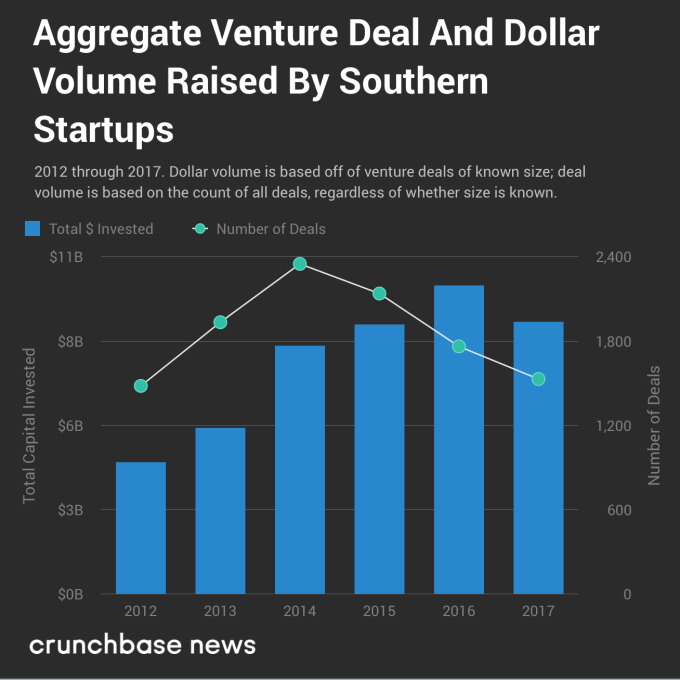

As is the case with many of the nation, the South seems to be experiencing a shift in startup funding as we transfer towards the latter half of a bull run in entrepreneurial exercise. The chart under exhibits a divergence in total deal and greenback quantity over time.

A lot like in the rest of the U.S., reported deal and greenback quantity are heading in several instructions. A part of this can be on account of reporting delays — it might generally take a couple of years for seed and early-stage rounds to get added to databases like Crunchbase’s . Nonetheless, there’s a sluggish and customarily upward creep in spherical sizes at most levels of funding. And that’s not only a Southern factor; it’s a country-wide trend.

Let’s disaggregate these figures a bit. We’ll begin with deal counts and transfer on to greenback quantity from there.

A better have a look at southern enterprise deal and greenback quantity

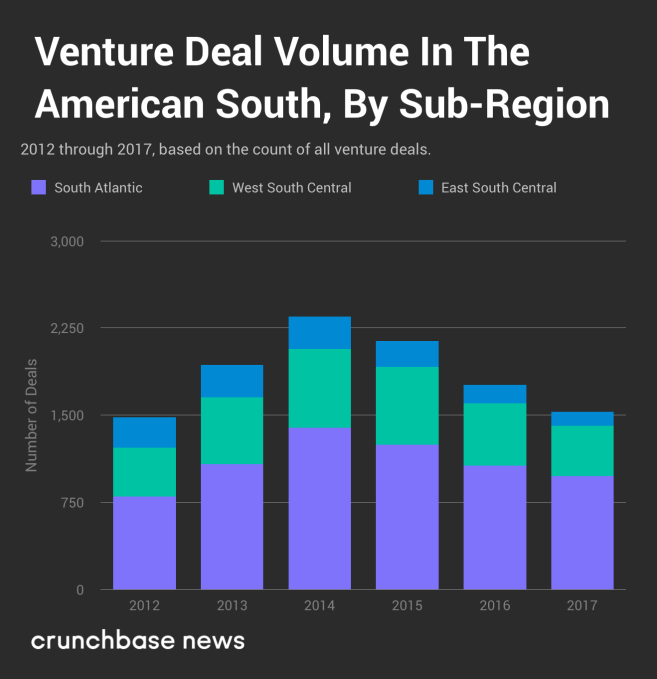

Within the chart under, you’ll see enterprise deal quantity damaged out by sub-region.

Over the previous a number of years, reported enterprise deal quantity has been on the downswing. From a neighborhood most in 2014 by means of the top of 2017, it’s down nearly 35 p.c total. However that’s not the entire image. The relative share of deal quantity has modified, as properly.

Though it’s not instantly clear simply by wanting on the chart above, startups within the South Atlantic sub-region have accounted for an more and more giant share of the funding rounds. For instance, in 2012, South Atlantic startups attracted 54 p.c of the deal quantity. In 2017, that grows to 64 p.c. Startups within the West South Central sub-region have fairly constantly pulled in between 28 and 30 p.c of the offers, so the place’s the loss coming from? Startups headquartered in Kentucky, Tennessee, Mississippi and Alabama pulled in simply eight p.c of offers in 2017, in comparison with 18 p.c in 2012.

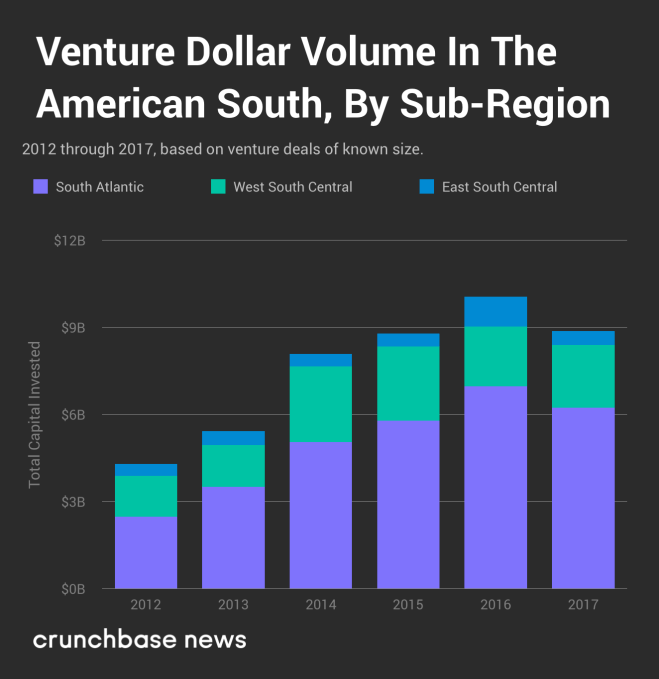

It’s the same story with greenback quantity.

Basically, greenback quantity follows the identical sample, albeit with a bit extra variability. Regardless, startups within the South Atlantic sub-region are hoovering up an ever-larger share of enterprise , and there’s little to point that development will reverse itself any time quickly.

The place are the regional hotspots for deal-making within the south?

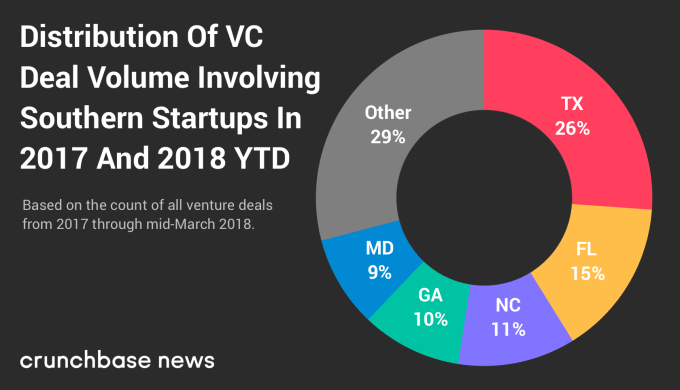

Let’s see which states accounted for many of the deal quantity. The chart under exhibits the geographic distribution of deal-making exercise by startups in every Southern state from the start of 2017 by means of time of writing. It ought to come as no shock that a lot of the exercise is concentrated in states with larger populations.

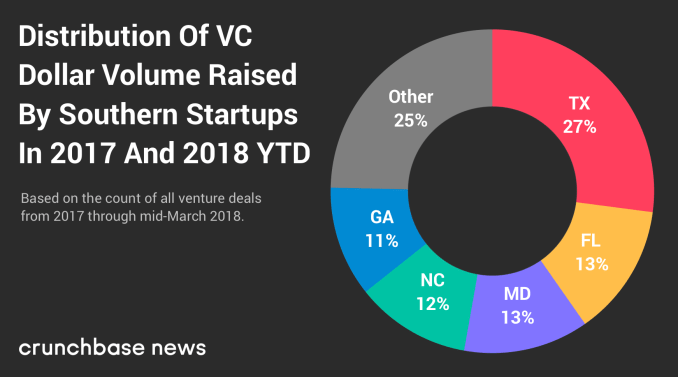

And right here’s the distribution of greenback quantity amongst southern states.

Regardless of some variation by which states are on the prime of the ranks, the share of deal and greenback quantity raised by startups within the prime three states is remarkably comparable, coming in at between 52 and 53 p.c for each metrics.

The highest startup cities within the south

We began by wanting on the South as a complete after which drilled into its sub areas and states. However there’s one layer deeper we are able to go right here, and that’s to rank the highest startup cities within the South.

Within the curiosity of retaining our rankings recent and well timed, we’re overlaying exercise from the previous 15 months or so, from the beginning of 2017 by means of mid-March 2018. However earlier than highlighting among the extra notable hubs, let’s check out the numbers.

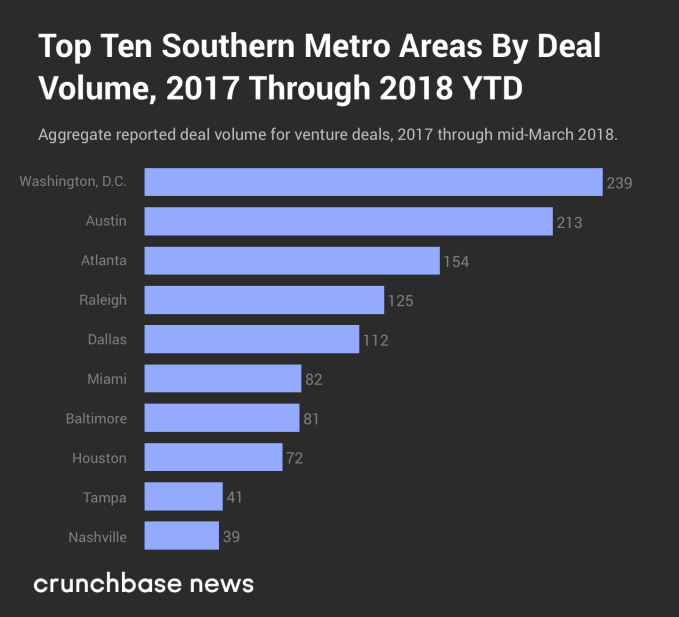

Within the chart under, you’ll discover the highest 10 metropolitan areas the place Southern startups closed essentially the most funding rounds.

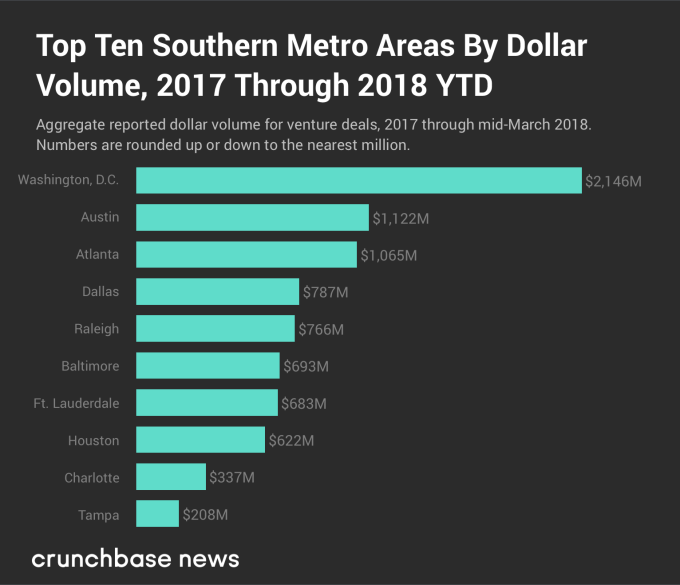

The chart under exhibits reported greenback quantity over the identical time period.

Very like we noticed on the state degree, the highest 5 startup cities — ranked by each deal and greenback quantity — are the identical, though there’s some variation between the place every one ranks. So as, the D.C., Austin and Atlanta metro areas rank within the prime three for every metric, whereas Dallas and Raleigh, NC swap off between fourth and fifth place.

Startups capitalize on the nation’s capital

To be frank, Washington, D.C.’s top-shelf rating was a little bit of a shock. It could be the truth that Austin, TX performs host to South By Southwest, a considerably extra relaxed tradition and/or a preponderance of fantastic breakfast taco and barbecue joints, however to many — ourselves included — the city feels like it would have a more active startup scene than the nation’s capital. However that’s not precisely the case. The D.C. metro space had extra enterprise deal and greenback quantity than Austin for seven out of the final 10 years, and startups primarily based within the nation’s capital have raised greater than twice as a lot cash to this point in 2018.

D.C.-area startups have not too long ago raised some notable rounds. Simply a few weeks previous to the time of writing, Viela Bio raised $250 million in a Series A round (in late February 2018) to proceed funding analysis and testing of its remedies for extreme irritation and autoimmune ailments. And on the later-stage finish of issues, training know-how firm Everfi raised $190 million in a Series D round that had participation from Amazon founder and CEO Jeff Bezos, former Alphabet govt Eric Schmidt and Medium CEO Ev Williams. Different D.C. corporations, together with Mapbox, Upside.com, Afiniti and ThreatQuotient, have all raised late-stage rounds inside the previous 15 months.

Startup ecosystems in Southern cities could pale compared to locations like New York and San Francisco, however it wouldn’t be sensible to low cost the area solely. A lot of fascinating corporations name the decrease half of the Decrease 48 house, and as the price of residing continues to rise on the east and west coasts, don’t be shocked if many present and would-be founders decide to remain down house within the South.