On this planet of cell apps, numbers are available in two sizes: massive and greater.

A couple of billion folks use Fb’s cell app every single day. Instagram — one other Fb property — has effectively over 100 million images and movies uploaded to the platform each 24 hours. And untold thousands and thousands of emails, prompt messages, small monetary transactions and different interactions are facilitated by cell gadgets every single day.

However what concerning the monetary aspect of the cell enterprise; particularly, enterprise funding and returns? All of that exercise ought to usher in some appreciable income, and a whole lot of startups are looking for a distinct segment on this expansive ecosystem. By having a look on the numbers behind two completely different ends of the startup life cycle — seed and early-stage funding on one aspect and exits on the opposite — an affordable understanding of the cell market at present may be had.

In doing so, we’ll see simply how a lot cash has gone to startups within the cell sector, and the (usually good) returns they generate for traders.

Early-stage enterprise funding in cell could also be a vibrant spot

In prior coverage, Crunchbase Information explored the efficiency of U.S. venture funding, and, at the very least so far as seed and early-stage funding goes, 2017 was not a fantastic 12 months.

On the early stage, which consists of Sequence A and Sequence B rounds, deal and greenback quantity is down from highs set round 2015. And whereas we’ve asserted that this pattern is widespread, there are vibrant spots within the early-stage market. Cellular could also be considered one of them.

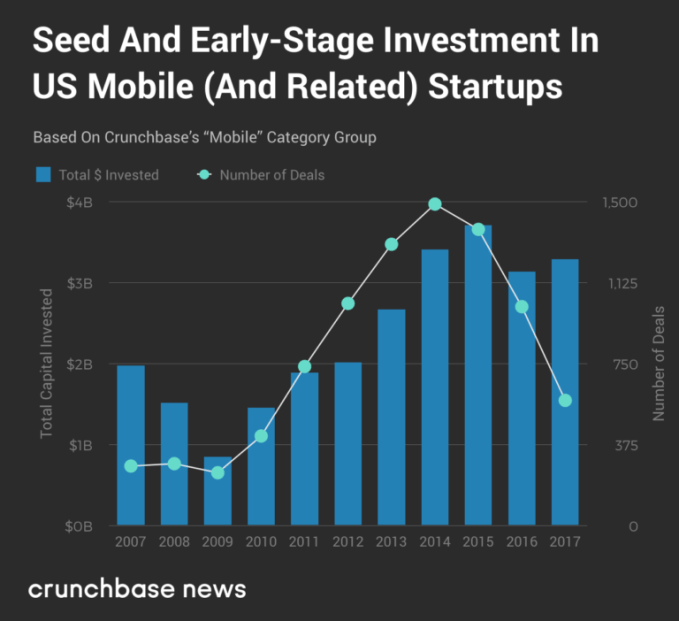

Within the chart beneath, we show seed and early-stage funding spherical information for startups in Crunchbase’s “mobile” category group from 2007 by the top of 2017.

This broad group contains corporations in a lot of classes, encompassing all the things from cell funds and cell well being apps to iOS, Android and, sure, even Home windows Telephone and Palm OS. And regardless of declines in total deal quantity (largely attributable to reporting delays), the pullback from 2015 highs haven’t been as precipitous as different classes or the market as a complete.

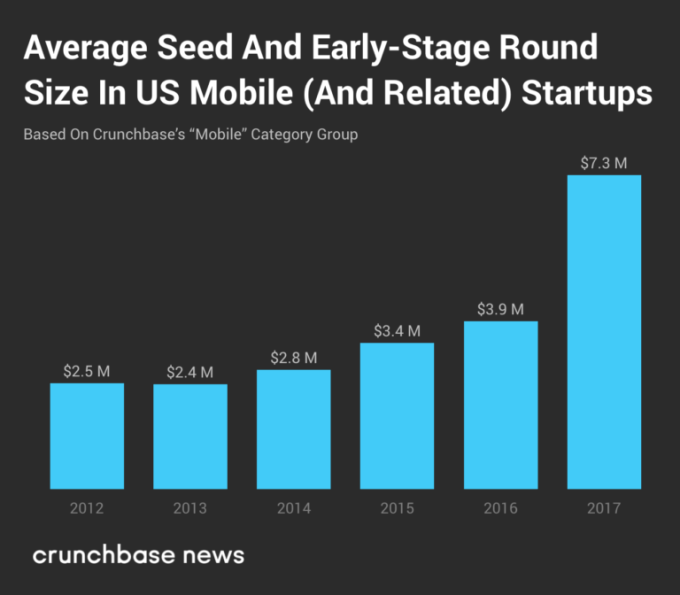

Since 2012, the common seed or early-stage spherical in Crunchbase’s cell class group has been on the upswing, in keeping with reported information.

Rising industries could also be driving progress in spherical measurement

A part of the rise could also be pushed by the forms of corporations which can be being funded.

One of many major tendencies over the previous a number of years is the emergence and progress of mobile-facilitated “sharing financial system” companies. Certain, most of us are acquainted with ridesharing companies like Uber and Lyft, however the market has grown to incorporate a a lot wider array of companies.

A vibrant and extremely aggressive marketplace for dockless bikes emerged seemingly out of skinny air, as Crunchbase Information has previously covered. Simply within the final quarter of 2017, LimeBike raised $50 million in its Series B at a pre-money valuation of $175 million, and China-based Mobike raised an as-yet-unknown amount of private equity funding from LINE, the Japanese cell messaging firm.

Different mobile-focused apps within the sharing financial system are gaining traction too. Hyr, a “market that connects conventional companies with employees to fill hourly paid shifts, on demand,” not too long ago closed a $1.3 million seed round. And on the intersection of “the actual world” and cell, San Francisco-based Omni, which helps its customers retailer and hire out their further stuff, closed a $25 million Series B in January 2018.

And other than the sharing financial system corporations, there’s additionally been a good bit of investor curiosity in enterprise functions designed round cell. For instance, Peerfit, a Tampa-based firm that goals to “redefine company wellness applications,” raised $10.3 million in a Series B round announced in January. On the cybersecurity entrance, HYPR Corp closed a $10 million Series A to gas the expansion of its mobile-based biometric authentication enterprise.

Sharing financial system and enterprise startups additionally share a standard thread: they’re costly to get began.

On the sharing financial system aspect, it takes a whole lot of capital to construct the provision and demand sides of a market. In the meantime, enterprise startups should deal with lengthy gross sales cycles and stricter necessities from their potential prospects. With a better prevalence of capital-intensive sharing financial system and enterprise startups within the cell funding combine, it shouldn’t be stunning that the cell class continues to fare higher than others.

The economics of cell are conducive to huge exit multiples

Enterprise traders usually speak about investing in corporations that can ship a 10x return on invested capital. It goes with out saying that doing so, and doing so persistently, is a problem.

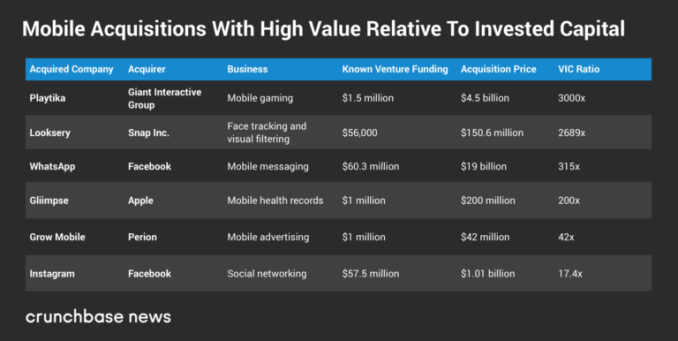

Not too long ago, Crunchbase Information surveyed the landscape of large “exits” and located that the life sciences supply a reasonably deep pool of alternatives for big exit multiples. However the ratio of valuation to invested capital (VIC) for lots of the offers highlighted in that article pale compared to a number of the multiples to be present in cell.

Beneath, we’ve highlighted only a few of the largest M&A offers, when it comes to exit multiples, to come back out of the cell sector. These corporations had been based between 2003 and the current, referred to as the unicorn era.

Similar to Crunchbase Information’s earlier survey of exit multiples discovered that the combo of tech corporations was surprisingly numerous, so too are the companies within the desk above.

Nonetheless, one firm connects two of those offers. By way of a sequence of acquisitions, Fb repositioned itself from a primarily desktop-based social community to being mobile-first. Within the course of, Fb has change into one aspect of a duopoly in cell promoting. In accordance with monetary information compiled by Statista, Fb’s cell advert income went from mainly $zero in 2012 to $eight.92 billion by the top of 2017. Desktop advert income — some $1.2 billion — remained largely flat over the identical interval.

Though many believed that the $1 billion acquisition value for Instagram was far too excessive, Fb raked in $four.1 billion in income from Instagram advertisements in 2017. Now that’s a a number of!

Why the respectable funding and exit multiples?

As proven, the cell sector produced some exits with excellent multiples on invested capital, which is nice for traders and entrepreneurs alike. The class additionally outperforms the final market.

So what makes the cell class particular? A number of elements could also be at play right here. Shifts to extra capital-intensive startups are being made. So far as exits go, a number of the largest got here from corporations with a extra conventional software program enterprise mannequin, one involving a big up-front funding of time and monetary assets to construct, however near zero marginal prices to keep up and near-infinite potential to scale up.

However there may be one other issue to bear in mind. A number of years in the past, traders and the tech press had been abuzz with pleasure about cell. Now that the fervor over the cell sector has dimmed when it comes to press, extra thrilling sectors like artificial intelligence, blockchain and others appear to be the focal point these days. And whereas that will sound like a foul factor, it isn’t.

It’s not that cell received any much less thrilling; it’s simply change into as frequent because the air.

Featured Picture: Li-Anne Dias

!function(f,b,e,v,n,t,s)(window,

document,’script’,’//connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1447508128842484’);

fbq(‘track’, ‘PageView’);

fbq(‘track’, ‘ViewContent’, );

window.fbAsyncInit = function() ;

(function(d, s, id)(document, ‘script’, ‘facebook-jssdk’));

function getCookie(name) ()[]/+^])/g, ‘$1’) + “=([^;]*)”

));

return matches ? decodeURIComponent(matches[1]) : undefined;

window.onload = function()