Notice: That is the ultimate article in a three-part collection on valuation ideas for widespread sectors of venture-capital funding. The primary article, which makes an attempt to make sense of the SaaS income a number of, will be discovered here; the second, on public marketplaces will be discovered here.

Over the previous 12 months, the VC-backed class acquired an enormous enhance — Roku was the best-performing tech IPO of 2017 and Ring was acquired by Amazon for a worth rumored to exceed $1 billion. Along with promoting into massive, strategic markets, each firms have wonderful enterprise fashions. Ring sells a high-margin subscription throughout a excessive proportion of its buyer base and Roku efficiently monetizes its 19 million customers via advertisements and licensing charges.

Within the context of those splashy exits, it’s attention-grabbing to think about the important thing components which have made for priceless firms towards a backdrop of an funding sector that has usually been maligned via the years, as I’m positive we’ve all heard the trope that “ is difficult.” Regardless of this notion, funding has grown a lot sooner than the general VC market since 2010, as proven under.

Supply: TechCrunch

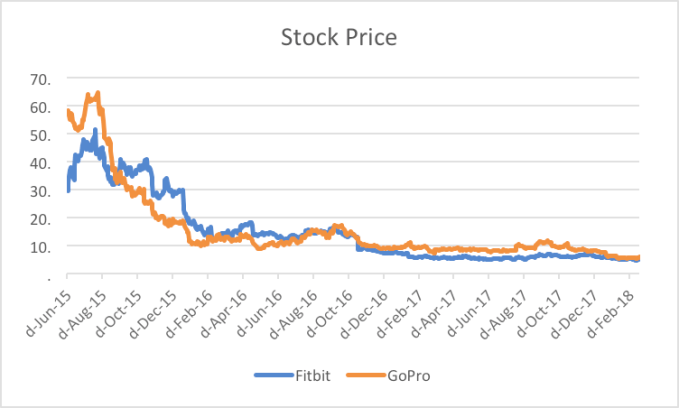

A big a part of this funding development has to do with the truth that we’ve seen bigger exits in over the previous few years than ever earlier than. Beginning with Dropcam’s* $555 million acquisition in 2014, we’ve seen various spectacular outcomes within the class, from massive acquisitions like Oculus ($2 billion), Beats ($three billion) and Nest ($three.2 billion) to IPOs like GoPro ($1.2 billion), Fitbit ($three billion) and Roku* ($1.three billion)**. Sadly for the sector, a number of of those firms have underperformed since exit; notably, GoPro and Fitbit have each cratered within the public markets.

As of April three, 2018, each shares traded at lower than 1x trailing income, a far cry from the multiples of ahead income given to different tech firms. Roku, however, continues to carry out as a inventory market darling, buying and selling at roughly 6x trailing income and a market cap of $three.1 billion. What units them thus far aside?

The easy reply is their enterprise mannequin — Roku generates a major quantity of excessive gross margin platform income, whereas GoPro and Fitbit are reliant on continued gross sales to drive future enterprise, a income stream that has been stagnant to declining. Nonetheless, Roku’s platform is one profitable enterprise mannequin; on this article I’ll discover 4 others — Connect, Substitute, Razor and Blades and Chunk.

Connect

“Attaching” a excessive gross margin annuity stream from a subscription to a sale is a purpose for a lot of startups. Nonetheless, that is usually simpler stated than performed — because it’s crucial to nail the alignment of the subscription service to the core worth proposition of the .

For instance, Fitbit rolled out teaching, however individuals purchase Fitbit to trace exercise and sleep — and this mismatch resulted in a low connect charge. Then again, Ring’s subscription permits customers to view previous doorbell exercise, which aligns completely with prospects trying to enhance residence safety. Equally, Dropcam offered a subscription for video storage, and at an approximate 40 % connect charge created a robust financial mannequin. Typically, we’ve discovered that the connect charge essential to create a viable enterprise needs to be at the very least within the 15-20 % vary.

Platform

Not like the “Connect” enterprise mannequin that sells companies straight associated to bettering the core performance of the gadget, “Platform” enterprise fashions create ancillary income streams that materialize when customers frequently have interaction with their . I think about Roku or Apple to be on this class; by having us glued to our smartphones or TV screens, these firms earn the privilege of monetizing an app retailer or serving us focused commercials. Right here, the income stream shouldn’t be tied on to the preliminary sale, and may conceivably scale properly past the margin that’s generated.

The truth is, AWS is among the extra profitable latest examples of a platform — by initially farming out the capability from current servers in use by the corporate, Amazon has generated an enormously worthwhile enterprise, with greater than $5 billion in quarterly income.

Substitute

Regardless of the wonderful economics of Apple’s App Retailer, as of the corporate’s newest quarterly earnings report, lower than 10 % of their practically $80 billion in quarterly income got here from the “Providers” class, which incorporates their digital content material and companies such because the App Retailer.

What actually drives worth to Apple is the substitute charge of their core money-maker — the iPhone. With the common client upgrading their iPhone each two to 3 years, Apple creates a large recurring income stream that continues to compound with development within the set up base. Distinction this with GoPro, the place a part of the explanation for its poor market efficiency has been its incapability to get prospects to purchase a brand new digital camera — upon getting a digital camera that works “properly sufficient” there may be little incentive to come back again for extra.

Razor and Blades

The most effective instance of that is Dollar Shave Club, which fairly actually offered razors and blades on its solution to a $1 billion acquisition by Unilever. This enterprise mannequin normally entails a low or zero gross margin sale on the preliminary “Razor” adopted by a long-term recurring subscription of “Blades,” with out which the unique product wouldn’t work. Current enterprise examples embody classes like 3D printers, however this mannequin isn’t something new — consider your espresso machine!

Chunk

Is it nonetheless attainable to construct a big enterprise when you don’t have any of the recurring income fashions talked about above? Sure — simply attempt to make hundreds of in gross revenue each time you promote one thing — like Tesla does. At 23 % gross margin and a mean promoting worth within the $100,000 vary, you’d want greater than a lifetime of iPhones to even strategy one automobile’s price of margin!

So, whereas I don’t suppose anybody would disagree that constructing a profitable enterprise has fairly actually many extra transferring components than software program, it’s attention-grabbing to think about the nuances of various enterprise fashions.

Whereas it’s clear that normally, recurring income is king, it’s troublesome to say that any of those fashions are intrinsically extra superior, as massive companies have been in-built every of the 5 classes coated above. Nonetheless, if compelled to decide on, a “Platform” mannequin appears to supply essentially the most unbounded upside because it’s indicative of a better engagement product and isn’t listed to the unique worth of the product (some individuals actually spend extra on the App Retailer than on the iPhone buy).

Whereas it’s straightforward to take a slim view of VC-hardware investing based mostly on the result of some splashy tech devices, broadening our aperture only a bit reveals us that giant companies have been constructed throughout a wide range of industries and enterprise fashions, and plenty of extra successes are but to come back.

*Signifies a Menlo Ventures funding

**Preliminary worth at IPO