Imagine it’s the yr 2030 and Nvidia has simply introduced its latest RTX 7000-series graphics playing cards. But the most cost effective of the playing cards is priced over $2,000 and the highest mannequin is almost double that. The collection provide minimal uplift on rendering efficiency, however they’re extremely good at accelerated upscaling and body technology. Plus, reminiscence bandwidth is sort of double over the last-gen fashions.

Let’s proceed the hypothetical: Nvidia’s new xx60-series playing cards aren’t anticipated for months whereas Nvidia stockpiles sufficient faulty GPUs. But don’t fear should you can’t afford these new playing cards or don’t need to wait. Why? Because GeForce Now presents the complete improve proper now for an “affordable” month-to-month payment, particularly with an annual sub locked in.

I wrote the above as a nightmare state of affairs, nevertheless it’s odd how shut it sounds to the launch of the RTX 50-series. It’s a historical past that appears more likely to repeat and speed up as Nvidia’s gaming division turns into an ever-more-minor facet hustle to its AI initiatives.

Nvidia might successfully surrender on gaming within the close to future, and that may be essentially the most financially wise factor to do if the AI bubble doesn’t burst. But what would occur in the event that they did?

Just observe the cash

The numbers behind my pessimistic prognosis paint a stark image. Nvidia’s Q3 2025 revenue topped $57 billion. Guess how a lot of that cash got here from information facilities? A whopping $51.2 billion. That’s simply shy of 90% of its whole income and represents a 25% enhance over the earlier quarter and a 66% enhance yr on yr.

How a lot income do you assume Nvidia pulled in from gaming? A measly $4.3 billion by comparability. That’s down 1% on the earlier quarter, and that’s regardless of having essentially the most highly effective graphics playing cards accessible and with inventory and costs being way more favorable than they had been earlier within the yr. It’s still up 30% on last year, however the distinction in potential between information facilities and gaming is staggering.

Nvidia

Indeed, gaming makes up lower than 8% of Nvidia’s whole income as of now, and though the general earnings from gaming continues to extend, it’s miniscule compared to its information heart take. Bullfincher highlights how quickly that’s changed, too: just some years in the past, gaming represented over 33% of Nvidia’s whole income.

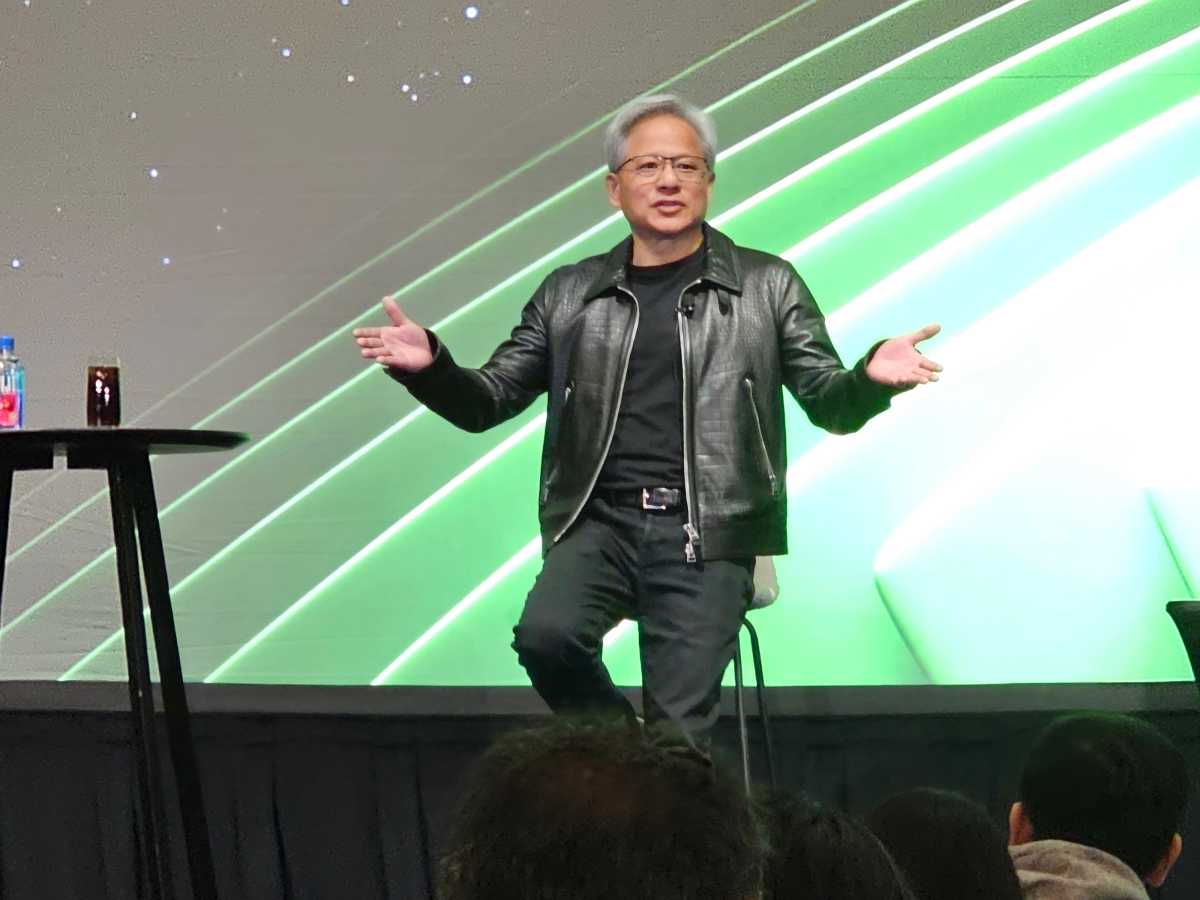

Where do you assume it’s going to be in one other 5 years? Assuming the AI bubble doesn’t pop as catastrophically because it might, gaming goes to grow to be a tiny footnote on Nvidia’s stability sheet. Will Jensen Huang even hassle doing gaming {hardware} keynotes at that time?

Mark Hachman / IDG

Nvidia may be the largest megacorp on this house, however its contemporaries present comparable gaming crimson flags on their stability sheets. AMD made just over $9 billion this past quarter, however $4.3 billion was from information heart gross sales whereas solely $1.3 billion got here from gaming. That’s much better than last year—when information facilities introduced in $3.5 billion and gaming simply $462 million—however information facilities are nonetheless a far greater portion of AMD’s income than gaming.

These numbers make a compelling case for giving up some curiosity and funding in gaming {hardware} improvement. It doesn’t imply they’re going to cease make gaming GPUs solely. (Or does it?) But should you’re Jensen Huang going through off towards shareholders who’re demanding the income numbers go up as a lot as doable as quick as doable, what are you going to promote them on: a brand new gaming GPU that has traditionally low margins, or a brand new technology of information heart {hardware} to feed into the accelerating AI bubble with untold potential?

You might even argue that Nvidia’s rising focus over the previous few years on DLSS and ray tracing over pure rasterization efficiency is an early signal of it placing its eggs within the information heart basket.

A canary within the RAM mines

The largest facet impact of all these new information heart builds hasn’t been GPU shortage, surprisingly. (At least, to not the diploma we noticed in the course of the cryptocurrency craze.) Rather, it’s skyrocketing memory prices. RAM kits have elevated in value by over 200 % in some instances, making massive capability kits extra pricey than top-tier GPUs. Some modest RAM choices are much more costly than gaming consoles.

Consumer RAM is taking pictures up in value as a result of all the main reminiscence producers are inundated with orders for data center memory, like HBM and LPDDR. Some have begun pivoting their fabrication strains to those higher-margin reminiscence varieties, resulting in shortages of NAND chips—and, consequently, shortages of consumer memory and SSDs.

Those shortages are making RAM and SSDs far costlier. And but, regardless of the elevated margins and diminishing provide versus demand, Micron just closed its Crucial brand of shopper RAM and SSDs.

It was worthwhile, it was in style, it had a definite market area of interest that served customers and players for many years. But even Micron didn’t see the purpose of protecting it going when it might as a substitute make heaps extra cash from promoting Micron NAND chips and server reminiscence.

And if Micron is so willing to pull out of the buyer house as a result of AI-driven demand, how rather more will Nvidia be tempted to do the identical? What’s stopping Nvidia from reaching the identical conclusion?

For additional proof of this future, Nvidia is rumored to be cutting its gaming GPU supply in 2026 as a result of reminiscence shortages. It’s particularly notable how Nvidia seems to be chopping the extra reasonably priced mid-range graphics playing cards first, leaving ultra-budget and ultra-high-end strains intact for now. Is this simply step one in Nvidia leaving players behind?

Where issues might go from right here

There are some intriguing comparisons to make between Nvidia and different huge companies that discovered development and income in avenues that weren’t the place they began. IBM went from being the title in computing {hardware} to 1 that largely runs within the background. It offered off its core {hardware} companies and have become a software program and companies firm that’s nonetheless value tens of billions of {dollars}. It just lately spun off once more, making a separate firm to deal with IT companies whereas the core enterprise refocused on cloud computing and AI.

Nvidia might do this: spin or unload its gaming divisions and license its GPU expertise to that spun-or-sold-off subsidiary.

Nvidia

Perhaps Nvidia might even find yourself like Adobe. In the mid-2010s, the developer of Photoshop launched Creative Cloud and slowly pushed all its once-in-perpetuity software program licenses right into a subscription mannequin that’s nonetheless occurring as we speak. Could that apply to Nvidia’s GeForce Now streaming service? It had 25 million subscribers as of 2023 and ran on GPUs designed for information heart server racks. Nvidia might depart devoted desktop and laptop computer GPUs behind solely and pivot its gaming divisions into software program/hardware-as-a-service corporations.

If gaming goes an analogous method to TV and film streaming, it’s doable Nvidia might even pull a Netflix and slowly de-emphasize its DVD-like {hardware} enterprise in favor of powering all of it from the cloud.

Gaming gained’t die, however it’s going to change

As a lot as this text is heavy on the doom, Nvidia is unlikely to exit gaming solely. People need to play video games and there’s cash to be made there, so somebody will hold tapping that market. But how that income is extracted might change—dramatically so.

Microsoft is already speaking about making the next Xbox more of a PC/console hybrid. And with the most recent Xbox consoles being the third wheel of this technology, it wouldn’t be a shock to see the way forward for Xbox focus extra on streaming video games than shopping for/proudly owning them. Xbox Game Pass already has over 37 million subscribers—that’s greater than the variety of Xbox Series X/S consoles offered this technology.

Nvidia might do one thing comparable. Or it might spin off. Or it might cease making gaming GPUs solely. The solely factor we all know for certain is that this: when a gaming firm begins making astronomical quantities of cash as a result of AI-driven demand, it’s laborious to think about it wouldn’t be tempted to dive head-first into an AI-first technique on the expense of gaming.

Further studying: PC vs. consoles? Gaming’s future is blurrier than ever